Your Practice is Your Largest Asset.

is it Protected?

Download the

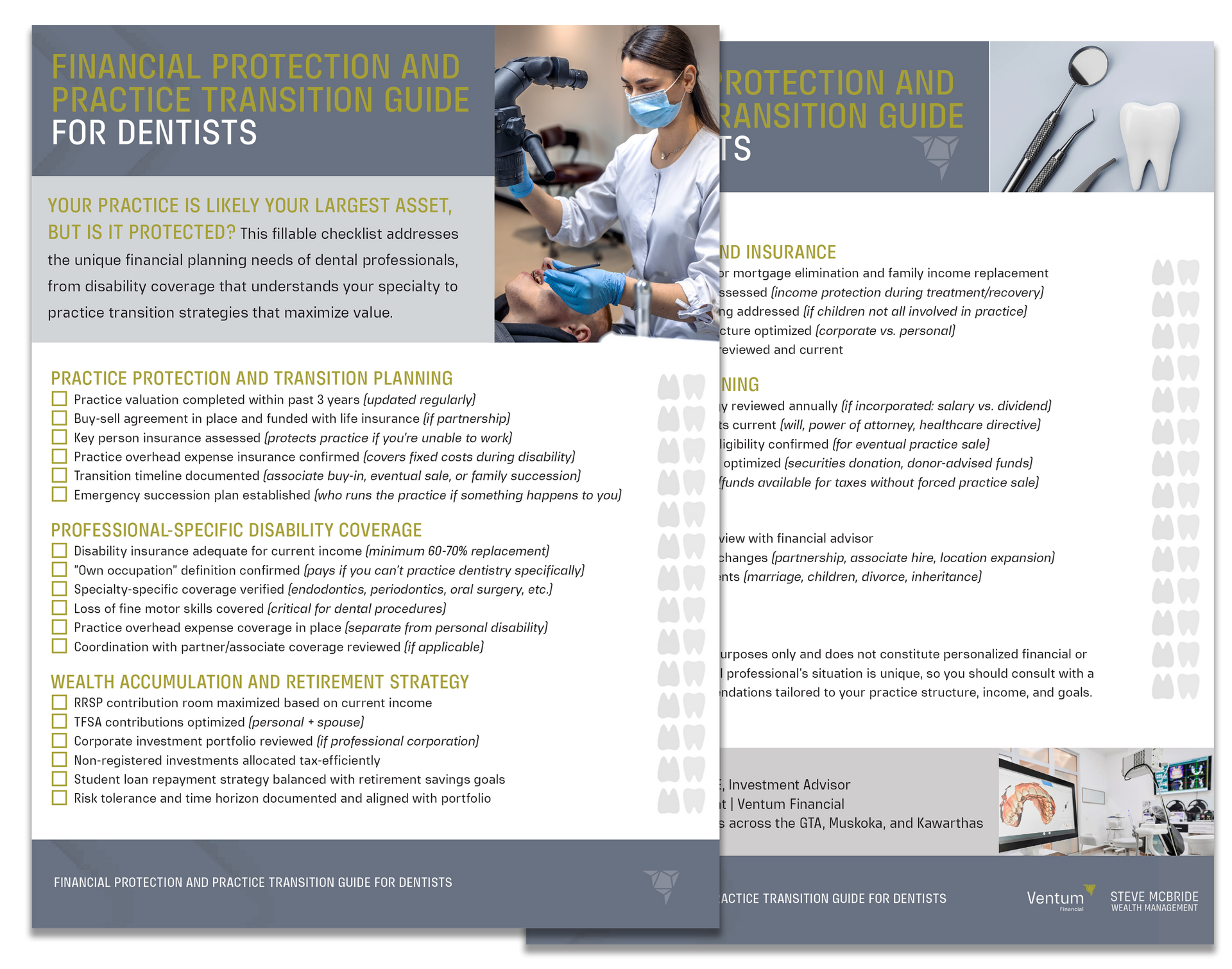

Financial Protection and Practice Transition Guide For Dentists

and discover the insurance gaps, succession planning blind spots, and wealth strategies most general advisors miss when working with dentists.

- Specialty-specific disability coverage (including loss of fine motor skills)

- Practice transition planning (buy-in, partnership, eventual sale)

- Buy-sell agreement funding and key person insurance

- Wealth diversification beyond your practice

- Tax-efficient retirement income strategies.

By clicking in the consent button, you are agreeing to receive emails and other electronic messages from McBride Wealth Management about market insights, events and services. You may unsubsribe at any time. We only collect your information to send the updates you may request and to manage our relationship with you in line with our Privacy Policy.

KEY BENEFITS

PRACTICE-SPECIFIC DISABILITY PROTECTION

Standard disability insurance doesn’t understand your profession. You need “own occupation” coverage that pays if you can’t practice dentistry specifically including loss of fine motor skills, tremors, or conditions that end your career but don’t qualify as “total disability” under generic policies.

PRACTICE TRANSITION AND SUCCESSION PLANNING

Whether you’re buying into a practice, adding a partner, or planning your eventual exit, the financial structure matters. Buy-sell agreements must be funded properly (typically with life insurance), practice valuations should be updated regularly, and transition timelines should align with your personal retirement goals not wait until the last minute.

WEALTH DIVERSIFICATION STRATEGY

If your practice represents more than 50% of your net worth, you’re not diversified. You’re concentrated in a single asset. Strategic wealth accumulation outside your practice (RRSPs, TFSAs, non-registered investments) protects your family if practice income drops, disability strikes, or you decide to exit earlier than planned.

WHY WORK WITH US?

WHAT MAKES MCBRIDE WEALTH DIFFERENT

DUAL-LICENSED ADVANTAGE

Most financial advisors are investment-only or insurance-only. I hold BOTH licenses, which means I can coordinate your complete financial picture, including investment portfolio, disability insurance, life insurance, practice succession planning, and retirement income strategy, in a single, integrated relationship.

DENTAL PROFESSION EXPERIENCE

I work with dental professionals across Ontario and understand the unique financial planning needs of your profession: practice cash flow patterns, partnership agreements, the importance of specialty-specific disability coverage, and the complexities of balancing aggressive student loan repayment with retirement savings.

INTEGRATED PLANNING APPROACH

Your practice transition plan should align with your retirement income strategy. Your disability insurance should coordinate with your investment portfolio. Your estate plan should protect both personal wealth and practice value. Most advisors address one area. I coordinate all of them.

HOW IT WORKS

YOUR NEXT STEPS ARE SIMPLE:

DOWNLOAD YOUR CHECKLIST

- Enter your email above and receive your comprehensive Dental Professional’s Financial Protection and Practice Transition Guide immediately. Review it at your convenience to identify planning gaps and opportunities you may be missing.

ASSESS YOUR CURRENT STRATEGY

- Use the checklist to evaluate your existing financial plan. Are all areas addressed? Is your advisor coordinating investments, insurance, and tax planning, or working in silos?

SCHEDULE A SECOND OPINION (OPTIONAL)

If you would like a professional assessment of your current strategy, I offer complimentary 20-minute consultations. No obligation, no sales pitch, just an honest evaluation of where you stand and what opportunities exist.

WANT TO DISCUSS YOUR SPECIFIC SITUATION

If you’re unsure whether your current financial plan addresses all the areas in this checklist, or if you’d like a second opinion on your corporate structure, investment strategy, or insurance coverage, I invite you to schedule a complimentary 20-minute consultation.

During this brief call, we’ll:

- Review your current financial structure (corporation, investments, insurance)

- Identify planning gaps or optimization opportunities

- Discuss whether integrated planning makes sense for your situation

- Answer your questions (no obligation, no pressure)

"As a dual-licensed advisor I can take a holistic view of your financial situation, aligning investment and insurance solutions so your entire plan works together toward long-term goals. This integrated approach gives dentists comprehensive planning without the complexity of coordinating multiple advisors.” – Steve McBride

STEVE MCBRIDE, BA

Steve is an Investment Advisor with Ventum Financial and the founder of McBride Wealth Management. With over 25 years of experience serving affluent Canadian families, Steve specializes in retirement income planning, tax-efficient wealth preservation, and integrated investment and insurance strategies.

What makes my approach different:

- Dual-licensed expertise: I hold both investment and insurance licenses, allowing me to coordinate your complete financial picture in a single relationship—not refer you to multiple advisors who don’t communicate.

- Professional corporation experience: I understand the complexities of professional corporations, holding companies, and the unique planning needs of dentists in Ontario.

- Integrated planning: Your investments, insurance, tax strategy, and estate planning should work together seamlessly. Most advisors address one area. I coordinate all of them.

Other Credentials:

- Member: Canadian Investment Regulatory Organization (CIRO)

- Member: Canadian Investor Protection Fund (CIPF)

- Part of Ventum Financial Corporation