Weekly Economics Report - Feb. 10, 2026

Take Five: Near, far, wherever markets are

LONDON, Feb 6 (Reuters) - The outcome of Japan's snap election, a heavy dose of key U.S. data, earnings season, and a slide in (some) tech shares suggest traders will have little downtime in the coming week.

Here is all you need to know about what's coming up in financial markets, by Rae Wee in Singapore, Lewis Krauskopf in New York and Karin Strohecker, Tommy Wilkes and Lucy Raitano in London.

1/ LANDSLIDE VICTORY

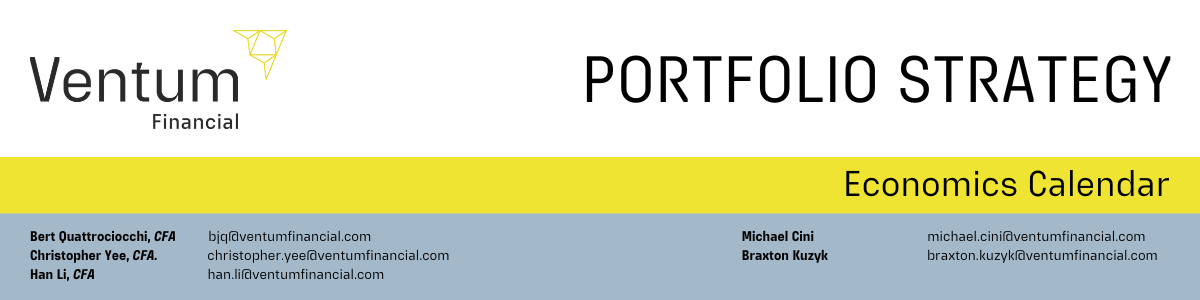

Japanese Prime Minister Sanae Takaichi's coalition swept to a historic election win over the weekend, paving the way for promised tax cuts and military spending aimed at countering China.

Investors reacted by sending Japanese stocks to all-time peaks on Monday while super-long bonds reversed early weakness, in an apparent vote of confidence in Takaichi's "responsible, proactive" fiscal policy.

The yen JPY= also held its ground, as the looming threat of a potential currency intervention left traders hesitant to push it lower.

While voters have given Takaichi a huge mandate to reflate the economy, investors say she has little room to run up deficits or pressure will be quickly back on bonds and the currency.

An early test will be how she handles a pledge to suspend Japan's 8% sales tax on food and how she plans to fund it.

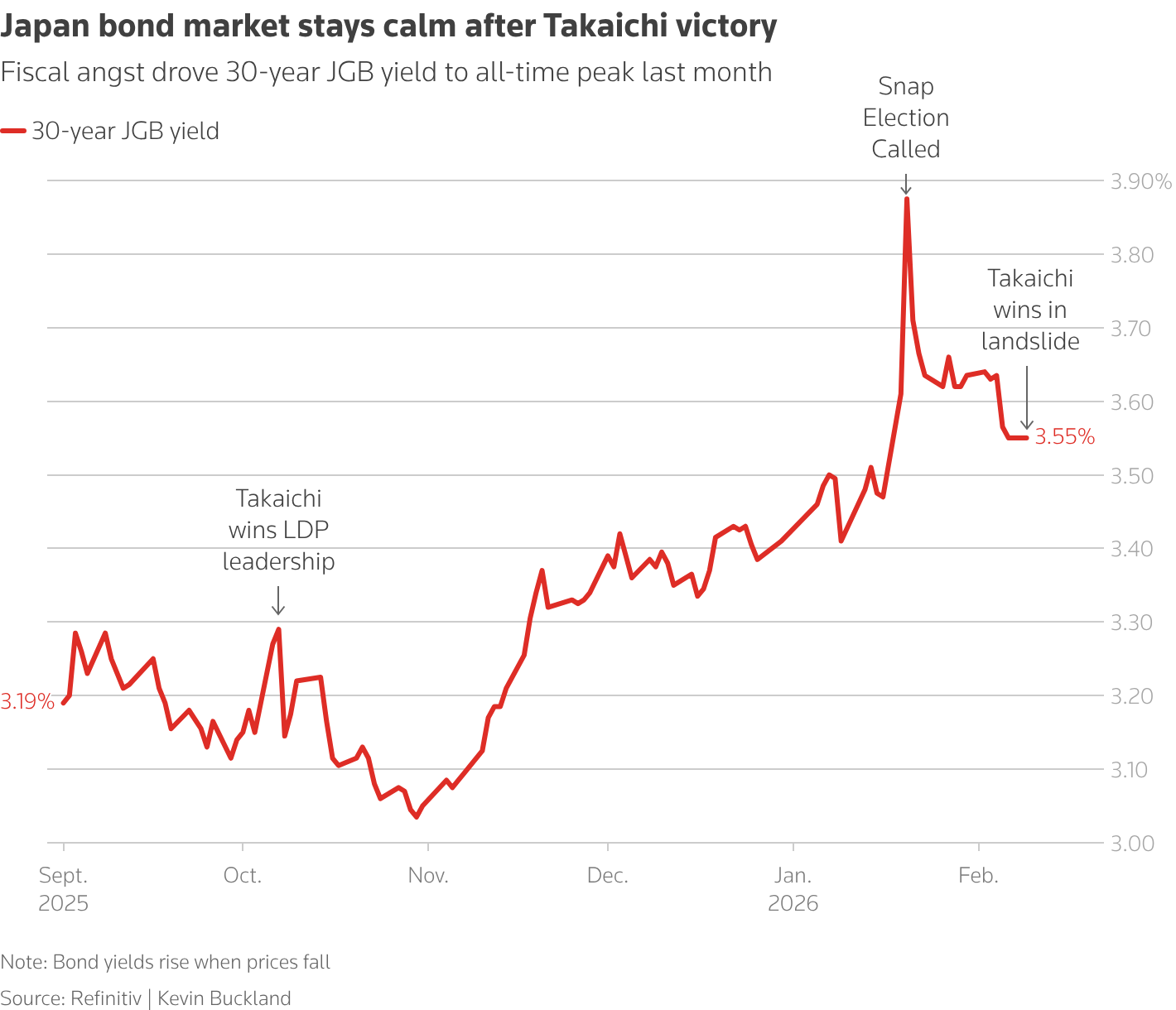

2/ AI SPLITS INTO WINNERS AND LOSERS

Cisco Systems CSCO.O and Germany's Siemens Energy report earnings on Wednesday.

They've benefited from the AI boom in different ways, but now Barclays says that trade is "seeing extreme dispersion". In other words, the market is sifting between the winners and losers with more conviction. The sensitivity to which companies are benefiting or suffering from AI disruption is evident in sliding software and data analytics stocks. They have plunged as traders honed in on the existential threat posed by increasingly powerful AI models. AI enablers, companies contributing to the global AI data centre build-out, meanwhile, have fared better. But with the spectre of a bubble popping and markets near record highs, it would be wise to hold onto your hats.

3/ DELAYED DATA DUMP

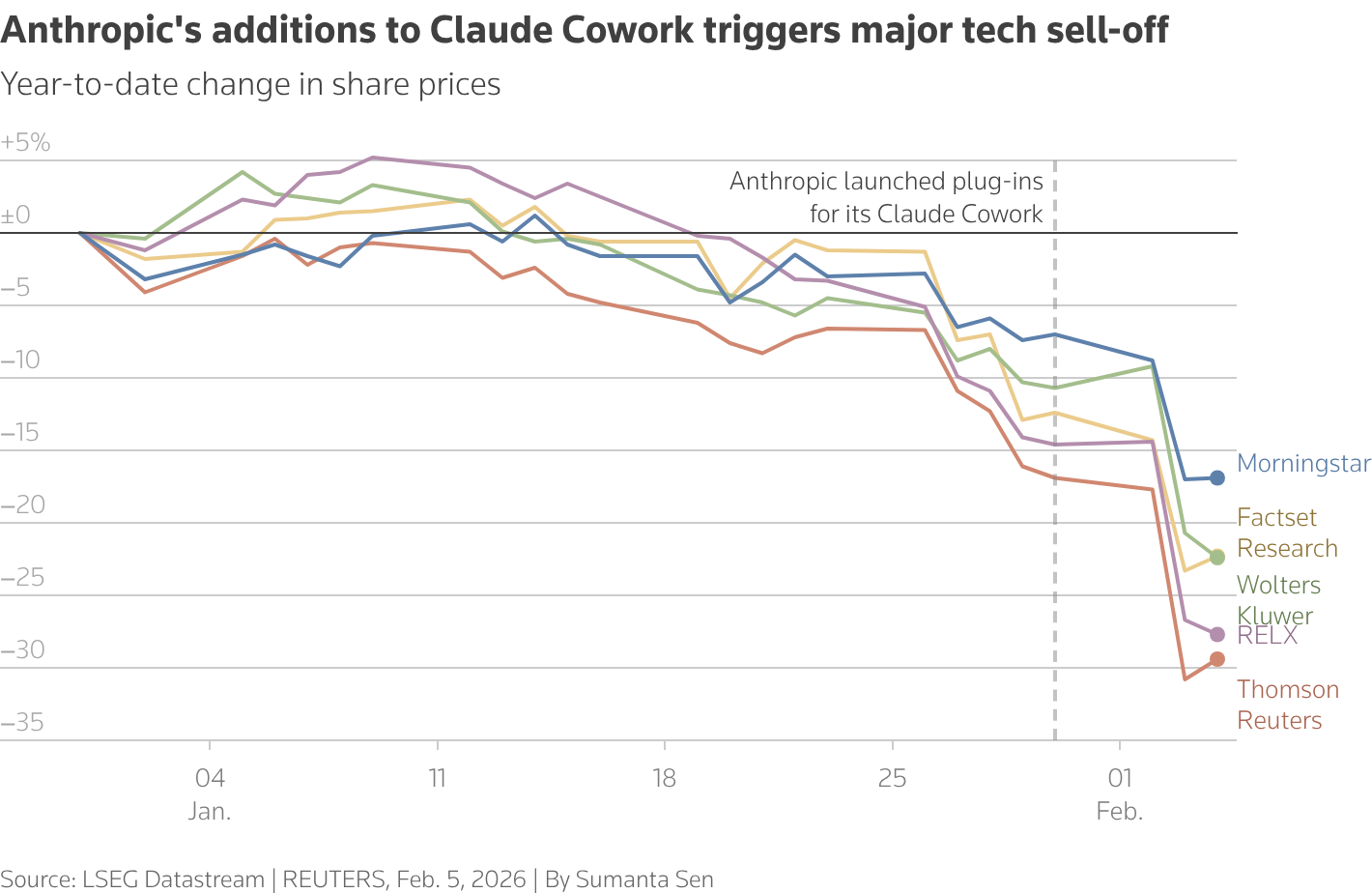

A double dose of major U.S. economic reports should give investors a critical view of the economy, after the releases were delayed a little by the recently ended three-day government shutdown.

The January non-farm payrolls report, now due on Wednesday, is expected to show an increase of 70,000 jobs, according to a Reuters poll. The Federal Reserve pointed to signs of stabilisation in the labour market as it held rates steady last month, pausing its easing cycle.

Two days later, the January consumer price index, one of the most closely watched measures for assessing inflation trends, is set to be published. The data comes as investors gauge the impact of newly nominated Fed chair Kevin Warsh, who could take charge in time for the Fed's June meeting. Markets currently price that meeting as the likely next time for a rate cut.

4/FROM MUNICH, WITH LOVE

The Munich Security Conference gets underway on Thursday. Now in its seventh decade, the annual gathering saw possibly its most consequential - and contentious — meeting in 2025 when a series of U.S. statements set the stage for a tectonic shift in the international order still underway today.

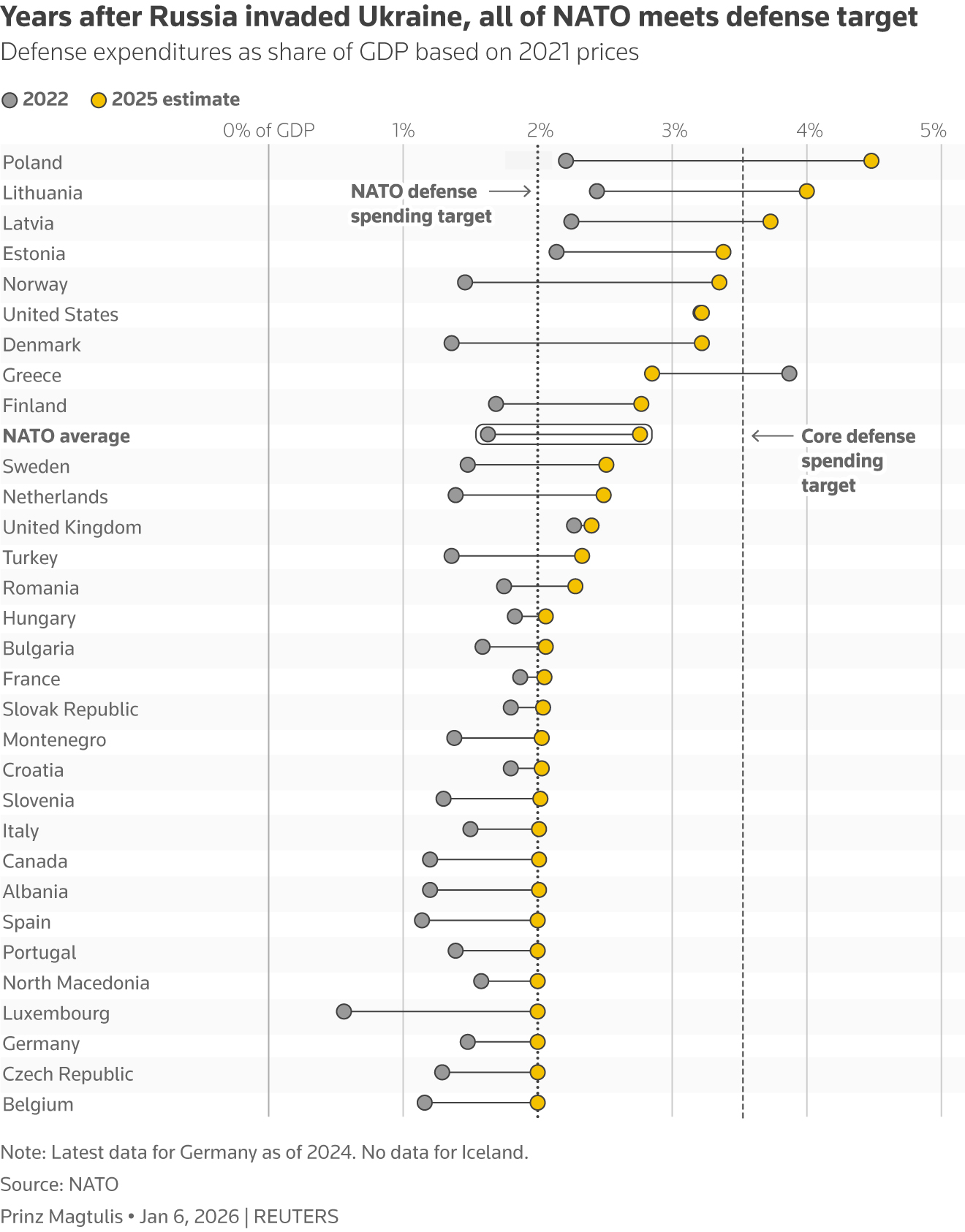

There is no shortage of hot geopolitical issues - from Iran to Ukraine and Greenland - while questions over the future role of NATO are looming large.

But the meeting looks to stretch beyond its usual scope: The European Central Bank is working on opening up access to euro liquidity to more countries - part of efforts to bolster the single currency's international role, sources told Reuters. The announcement will likely come from ECB chief Christine Lagarde, who will open a roundtable on trade dependencies at the conference.

5/ EUROPEAN BANKS' TIME IN THE SUN OVER?

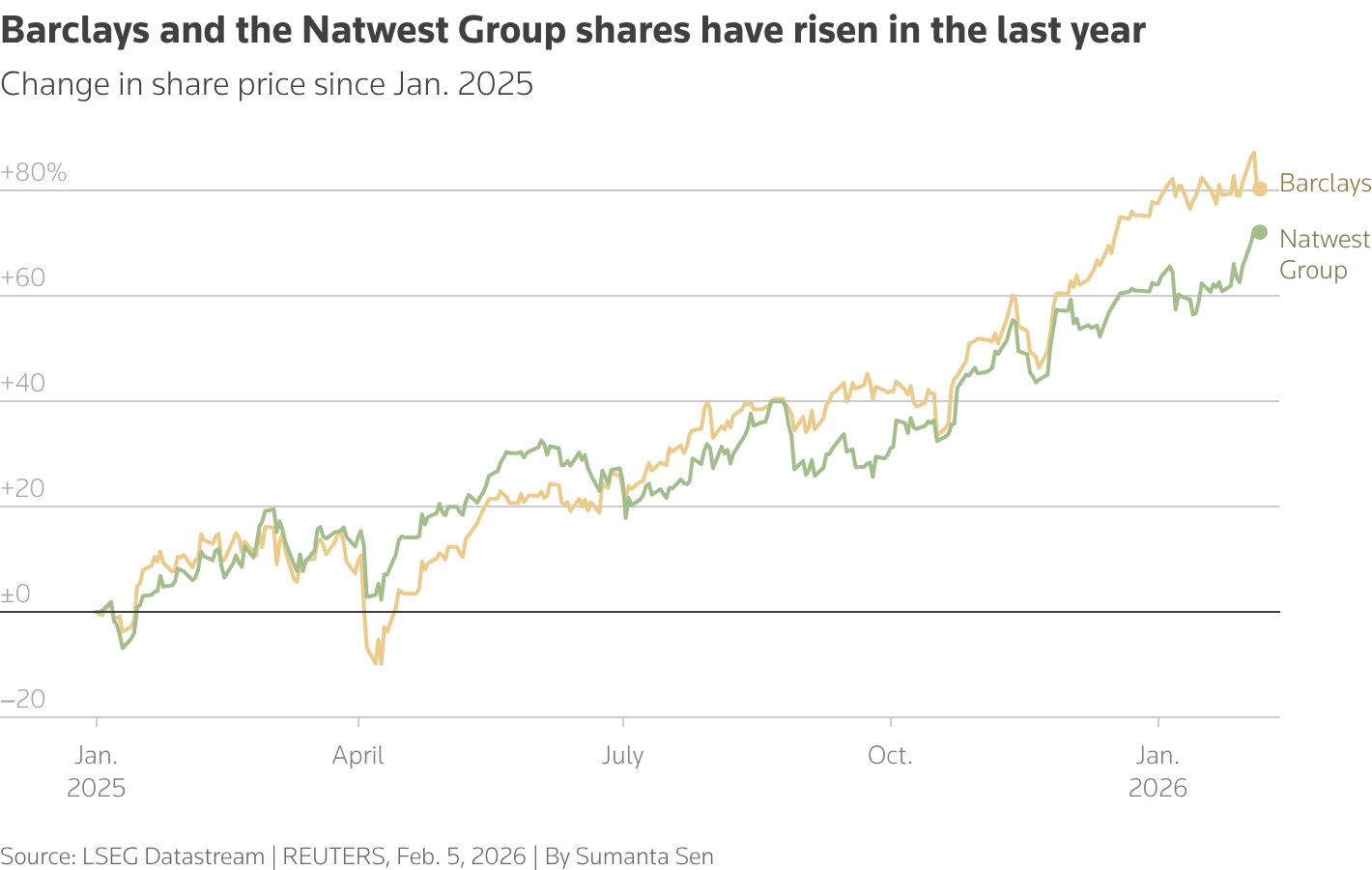

European banks have been among the best performing stocks in the past 12 months .SX7P with a more than 60% gain, aided by rising profitability, low loan defaults and a showering of shareholders with cash.

Britain's Barclays BARC.L and NatWest NWG.L and Italy's UniCredit CRDI.MI report 2025 earnings in coming days, following generally strong numbers already from Deutsche Bank DBKGn.DE and BNP Paribas BNPP.PA. The French lender and Lloyds LLOY.L also lifted their key profitability targets.

But analysts warn the good times cannot last, especially if European economies slow. Spain's BBVA BBVA.MCsaw a 7% drop in its shares on Thursday after it set aside 19% more in cash for loan losses in the fourth quarterthan a year earlier. As well as financial prospects, investors are looking for signs that bosses have an appetite to spend more of their excess capital on deals - such as Santander's recently announced $12.2 billion acquisition of U.S. lender Webster Financial WBS.N.

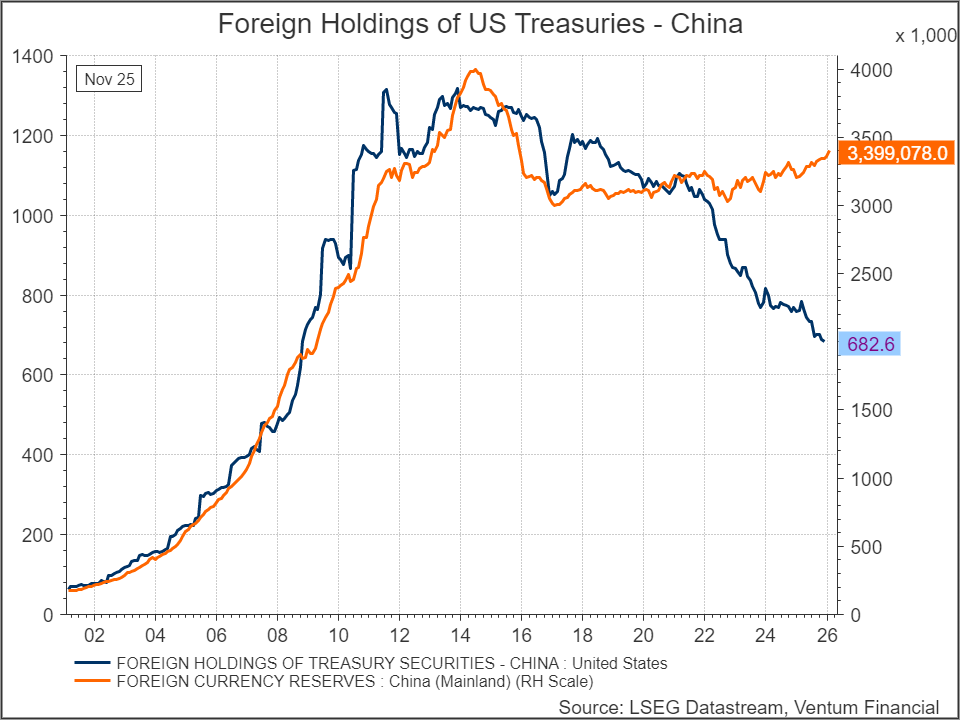

China's forex reserves grow more than expected in January

The country's foreign exchange reserves, the world's largest, rose to $3.399 trillion last month, exceeding the $3.372 trillion forecast in a Reuters poll. The reserves totalled $3.358 trillion in December.

The yuan CNY=CFXS rose 0.45% against the dollar last month, while the dollar softened 1.15% against a basket of major currencies =USD.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post