Weekly Economics Report - Sept. 19, 2025

Canada Wholesale Sales Growth Hits Six-Month High

Canada’s wholesale sales climbed 1.2% month-on-month to C$86.0 billion in July 2025, the fastest gain since January, accelerating from an upwardly revised 1.0% increase in June but slightly below market expectations of 1.3%. Four of the seven subsectors posted gains, accounting for roughly three-quarters of total wholesale trade.

The largest increases came from the motor vehicle and motor vehicle parts and accessories subsector (+5.1% to C$15.4 billion), driven by a 5.9% increase in motor vehicle sales, and the building materials and supplies subsector (+2.7% to C$12.1 billion), with all industry groups in the sector contributing, led by a 2.7% increase in lumber, millwork, hardware and other building supplies. These gains were partially offset by a decline in the miscellaneous subsector (-1.5% to C$10.7 billion). Regionally, wholesale sales rose in seven provinces, led by Ontario (+1.5% to C$44.7 billion) and Alberta (+2.6% to C$9.5 billion).

Source: Trading Economics

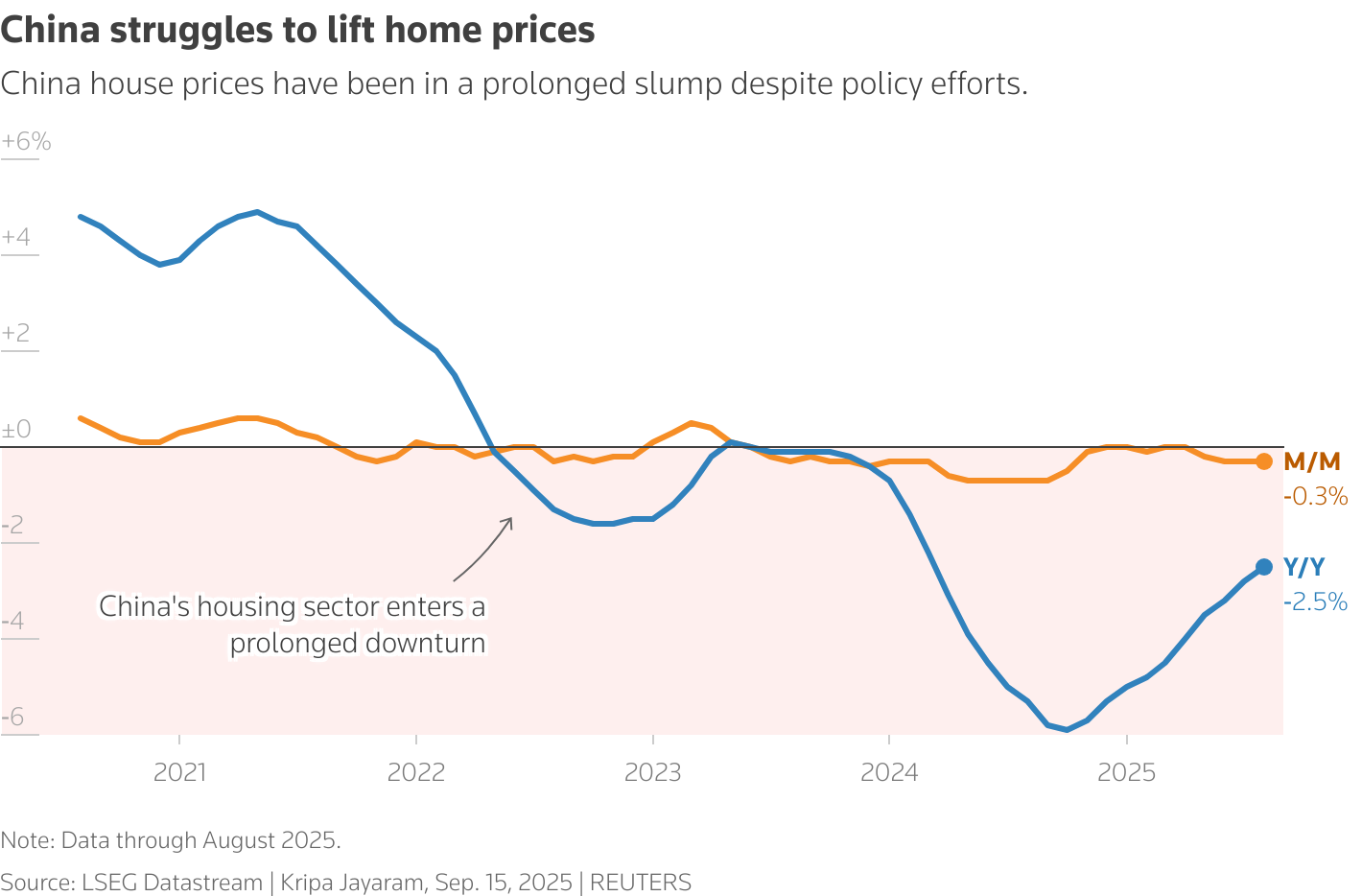

China’s home prices extend decline, more policy support needed

BEIJING, Sept 15 (Reuters) - China's new home prices fell again in August, extending a prolonged slump in prices as persistently weak demand in the pivotal housing sector remains a drag on economic growth.

Prices slipped 0.3% in August from the previous month, according to Reuters calculation based on data released by the National Bureau of Statistics. The figure matched July's month-on-month decline and extended a weak trend that has persisted since May 2023.

On an annual basis, new home prices dropped 2.5% in August, narrowing from a 2.8% decline in July.

China's real estate sector entered a downturn in 2021. Multiple rounds of stimulus measures, from mortgage rate cuts to launching a programme for renovating urban villages, have so far failed to achieve a sustained turnabout. A spokesperson for the statistics bureau told a press conference on Monday that the property sector was still stabilising, despite some volatility, and more effort was needed to support demand.

The sector, which accounted for about a quarter of economic activity prior to its collapse four years ago, remains a heavy drag on the world's second-largest economy.

Authorities have stepped up efforts to boost consumption and curb price wars to meet Beijing's around 5% growth target in 2025, but deflationary pressures and U.S. tariffs have added to economic headwinds. "Based on current data and market trends, the real estate market is likely to face significant adjustment pressure in the near term," said Zhang Dawei, a property analyst at Centaline.

"The market is anticipating stronger measures to stabilise the housing sector, including easing home purchase restrictions, looser credit policies, and, in particular, a potential interest rate cut on the Loan Prime Rate (LPR) on September 20," Zhang added. Of the 70 cities surveyed, 57 reported month-on-month declines, and 65 recorded year-on-year falls.

Resale prices also weakened. Prices in tier-one cities fell 3.5% year-on-year, while tier-two dropped 5.2% and tier-three prices were down 6.0%.

Separate data showed property investment slumped 12.9% year-on-year in January–August, with property sales by floor area falling 4.7%.

Mainland and Hong Kong property stocks slid in early trading, with the Hang Seng China Mainland Property Index .HSMPI and the CSI 300 Real Estate Index .CSI000952 dropping 2.3% and 0.7%, respectively.

Iron ore futures prices slipped on Monday due to ongoing weakness in China's property sector, even as steel and steelmaking ingredients rose.

Most analysts in a Reuters poll expect home prices to stabilise no earlier than the second half of 2026 or 2027, about half a year later than expectations three months ago.

Weak income expectations, elevated unemployment pressures, and high listings in the secondary market continue to dampen buyer sentiment, particularly in smaller cities burdened with high inventory, analysts say. Households, which saw their wealth shrink in the real estate downturn, have tightened their purse strings while business confidence has faltered, dampening the job market.

In the past few weeks, Shanghai and Shenzhen, two of China's biggest cities, further eased homebuying curbs, scrapping them in some districts for qualified buyers. The central government, meanwhile, kept its policy calls for stabilising the market. Premier Li Qiang said in a meeting in August that China should "adopt forceful measures to consolidate the stabilising trend" in the real estate market and stimulate demand for housing upgrades.

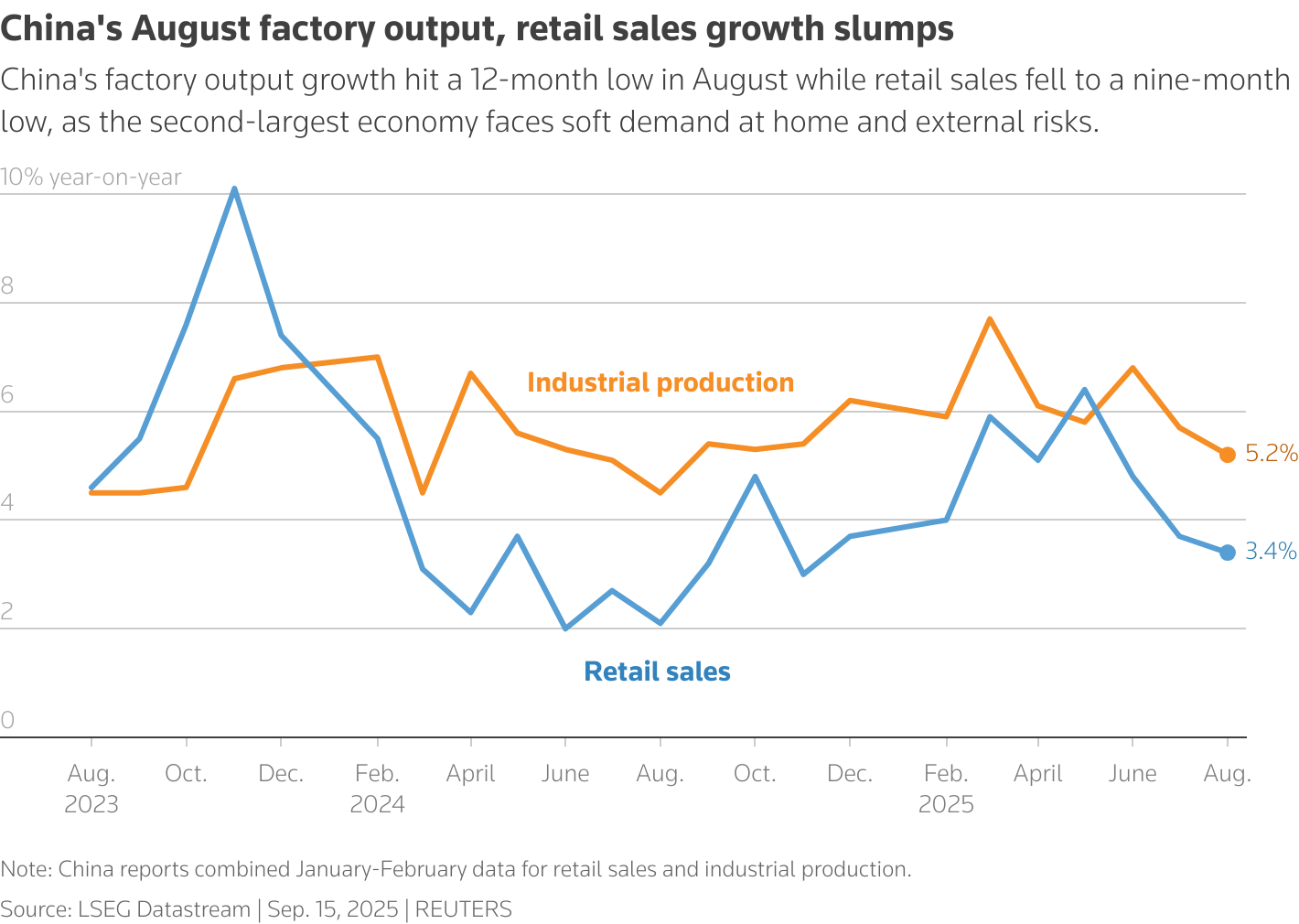

China’s economy slumps in August, casts doubt on growth target

BEIJING, Sept 15 (Reuters) - China's factory output and retail sales reported their weakest growth since last year in August, keeping pressure on Beijing to roll out more stimulus to fend off a sharp slowdown in the world's second-largest economy. The disappointing data split economists over whether policymakers would need more near-term fiscal support to hit their annual growth target of "around 5%," with manufacturers awaiting more clarity on a U.S. trade deal and domestic demand curbed by a wobbly job market and property crisis.

Industrial output grew 5.2% year-on-year, National Bureau of Statistics data showed on Monday, the lowest reading since August 2024 and weaker than a 5.7% rise in July. It also missed forecasts for a 5.7% increase in a Reuters poll. Retail sales, a gauge of consumption, expanded 3.4% in August, the slowest pace since November 2024, and cooling from a 3.7% rise in the previous month. They missed a forecast gain of 3.9%. "The strong start to the year still keeps this year's growth targets within reach, but similar to where we were at this time last year, further stimulus support could be needed to ensure a strong finish to the year," said Lynn Song, chief economist, Greater China at ING.

"While it is too early to gauge the impact of the consumer loan subsidies coming into effect in September, it is likely that more policy support is still needed, given the broader slowdown across the board. We continue to see a high possibility for another 10bp rate cut and 50bp RRR cut in the coming weeks."

Fixed-asset investment also grew at a slower-than-expected 0.5% pace in the first eight months year-on-year, from 1.6% in January-to-July, marking its worst performance outside the pandemic. Authorities are leaning on manufacturers to find new markets to offset U.S. President Donald Trump’s unpredictable trade policy and weak consumer spending.

Separate data this month showed factory owners have had some success diverting U.S.-bound shipments to Southeast Asia, Africa and Latin America, but the drag from the property crisis continues to offset efforts to steady the economy. Zhaopeng Xing, senior China strategist at ANZ, said that while the data showed momentum in the world's second-largest economy was weakening, it was not yet bad enough to trigger a new round of stimulus. "Policies and measures to support service consumption are expected to offset the impact of aggregate demand this month," he said, adding an official crackdown on firms aggressively cutting prices made domestic demand appear worse than it was.

HOUSEHOLD PRESSURE

Chinese households, which have seen their wealth shrink in the real estate downturn, have tightened their purse strings as business confidence falters, dampening the jobs market.Unemployment edged up to a six-month high of 5.3% in August, from 5.2% a month prior and 5.0% in June.

Meanwhile, new home prices fell 0.3% last month from July and 2.5% on an annual basis, a different NBS dataset showed. "We had expected that retail sales growth would have stayed above 4% before September under consumer subsidies, so what happened these months was a disappointment," said Xu Tianchen, senior economist at the Economist Intelligence Unit.

Xu said that China's main economic indicators could worsen over the fourth quarter due to base effects. Officials typically reach for further policy support towards the year end to ensure the economy hits the growth target. "This will raise the likelihood of stimulus in the fourth quarter, including monetary easing, frontloading of debt issuance to this year, and possibly a fiscal expansion," he added.

Zheng Shanjie, head of China's state planner, said last week that Beijing would make full use of fiscal and monetary policies and improve its toolkit to achieve annual targets. Weather has also not helped, with manufacturing activity affected by the hottest conditions since 1961 and the longest rainy season for the same period.

"But there are more fundamental headwinds too, including fading fiscal support and efforts to curtail overcapacity," said Zichun Huang, China economist at Capital Economics. "While the weak data may trigger some additional policy easing over the coming months, the likelihood is that this proves insufficient to turn things around," she added.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post