Weekly Economics Report - Aug. 18, 2025

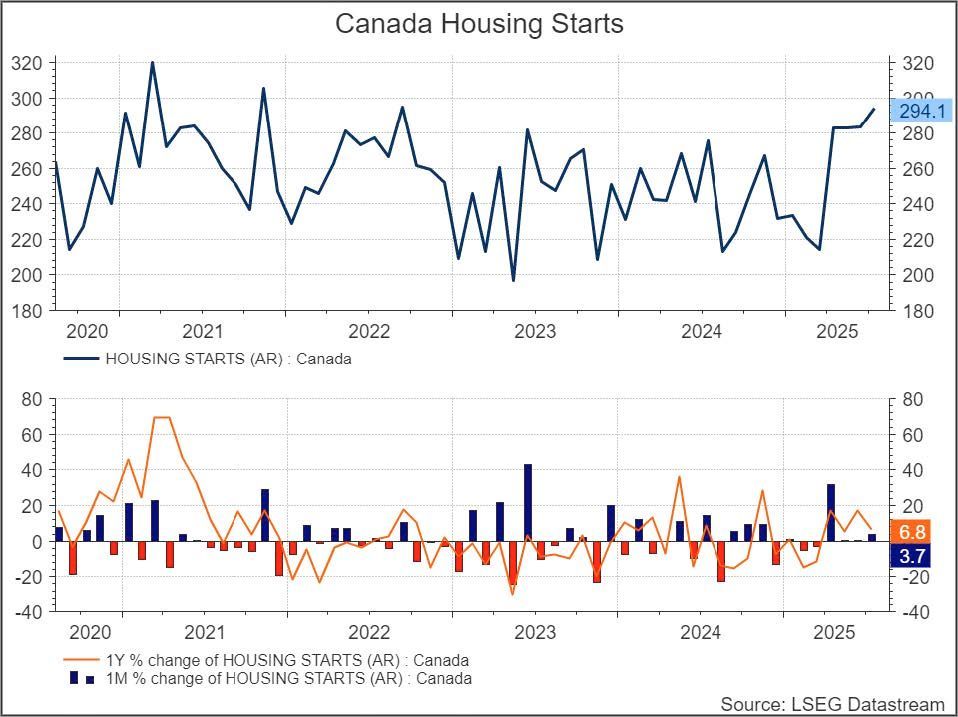

Canadian housing starts rise 4% in July - CMHC

TORONTO, Aug 18 (Reuters) - Canadian housing starts unexpectedly rose in July, advancing 4% from the previous month, data from the national housing agency showed on Monday.

The seasonally adjusted annualized rate of housing starts rose to 294,085 units from a revised 283,523 units in June, the Canadian Mortgage and Housing Corporation (CMHC) said. Economists had expected starts to fall to 265,000.

US homebuilder sentiment dips back to lowest level since late 2022

Aug 18 (Reuters) - A gauge of U.S. homebuilder sentiment fell unexpectedly in August, slipping back to its lowest level in more than two-and-a-half years, with more than a third of residential construction firms cutting prices and roughly two-thirds of them offering some form of incentive to lure buyers sidelined by still-high mortgage rates and economic uncertainty.

The National Association of Home Builders/Wells Fargo Housing Market Index fell to 32, matching the lowest reading since December 2022, from 33 in July, the association said on Monday. Economists polled by Reuters had expected the sentiment score to improve to 34.

NAHB's measure of current sales conditions declined, and an index tracking future sales expectations was unchanged. Buyer foot traffic, though, edged up to its highest level since May, though it remains at a low level. On a regional basis, sentiment among builders in the Northeast skidded to its lowest level since January 2023, while it was unchanged in the South and Midwest and modestly improved in the West.

"Affordability continues to be the top challenge for the housing market and buyers are waiting for mortgage rates to drop to move forward," said NAHB Chairman Buddy Hughes, a home builder and developer from Lexington, North Carolina. "Builders are also grappling with supply-side headwinds, including ongoing frustrations with regulatory policies connected to developing land and building homes."

Mortgage interest rates have shown recent signs of easing amid expectations the Federal Reserve will resume its interest rate cuts at a policy meeting next month. The average rate on a 30-year fixed-rate mortgage, the most common U.S. home loan, slipped to 6.58% last week, the lowest level since last October, according to data from Freddie Mac. Rates have fallen nearly half a percentage point since the start of the year.

"Given a slowing housing market and other recent economic data, the Fed's monetary policy committee should return to lowering the federal funds rate, which will reduce financing costs for housing construction and indirectly help mortgage interest rates," NAHB Chief Economist Robert Dietz said.

The use of price and other incentives remains high, with 37% of builders cutting prices - by an average of 5% - while 66% offered some form of sales incentive, the highest percentage in the post-COVID-19 era.

On Tuesday the Census Bureau is due to report data for July on ground-breaking volumes and building permit filings for new homes, both of which remain depressed. In June, single-family housing starts fell to an 11-month low and permits for new homes plunged to the lowest level in more than two years. Economists polled by Reuters see little prospect for improvement in July's data.

Take Five: From Anchorage to Jackson Hole

Aug 18 (Reuters) - There seems to be very little standing in the way of stock-market bulls right now, but what follows a U.S./Russia summit in Alaska, a central bank shin-dig in Wyoming and the outcome of Bolivia's election may imbue them with some caution.

Here's what coming up in the week ahead in financial markets from Lewis Krauskopf and Suzanne McGee in New York, Kevin Buckland in Tokyo, Dhara Ranasinghe in London and Libby George in Minneapolis.

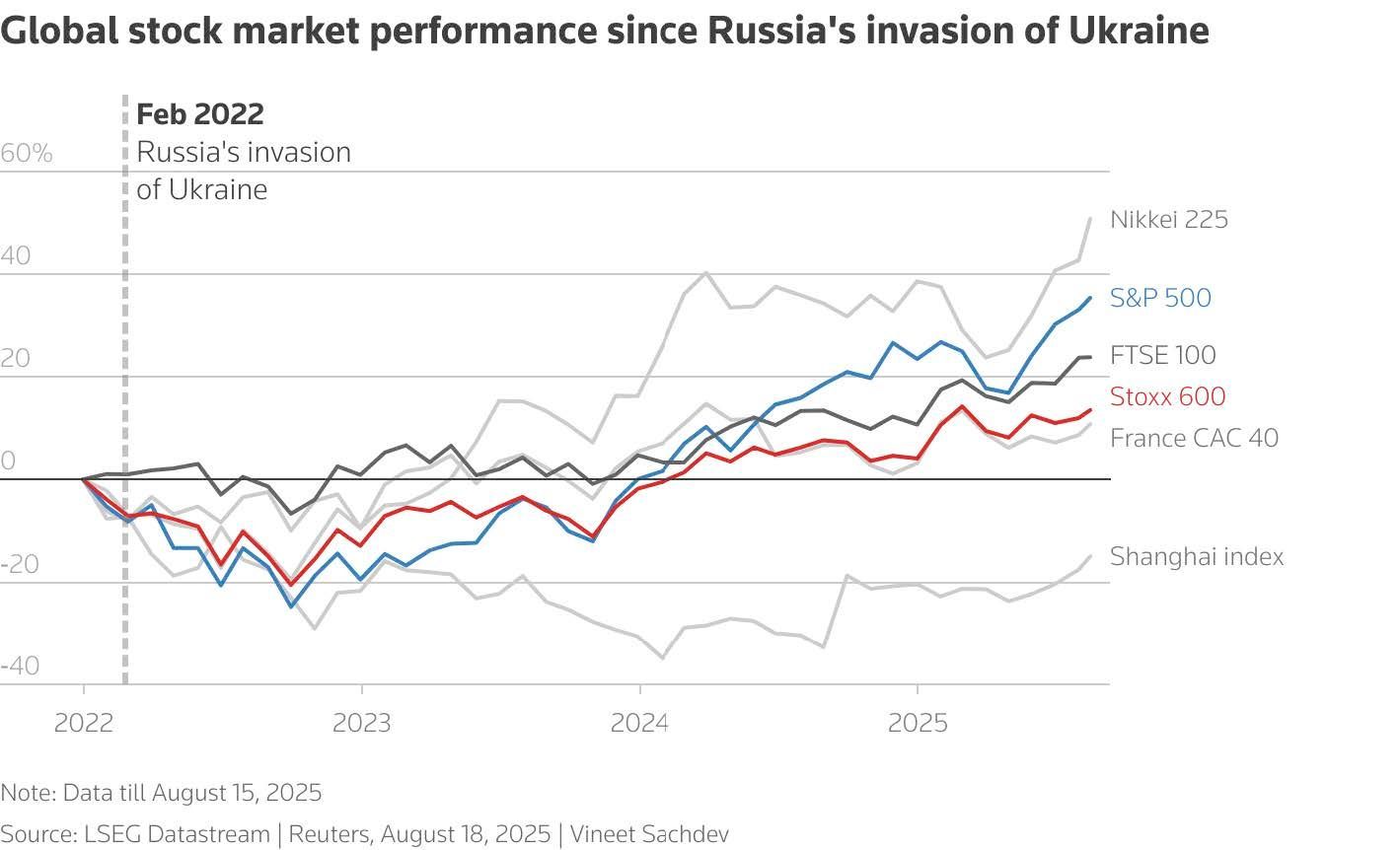

1/ BEGINNING OF THE END?

Following Friday's meeting between Donald Trump and Russian President Vladimir Putin, it's the turn of Ukraine's President Volodymyr Zelenskiy and European leaders to meet the U.S. President later on Monday to map out a peace deal.

The fear is Trump could try to pressure Kyiv into accepting a settlement favourable to Moscow. Zelenskiy has already all but rejected the outline of Putin's proposals, including for Ukraine to give up the rest of its eastern Donetsk region, of which it currently controls a quarter.No doubt, markets will be hesitant to price in an end to the war until a ceasefire, at least, is agreed.Europe, meanwhile, is unlikely to embrace Russia, even if peace returns to Ukraine. Defence stocks are likely to remain an investor favourite for now.

2/ JACKSON HOLE-IN-ONE

It's officially summer in financial markets. Q2 earnings are out, the next crop of major economic data isn't until early September and many money managers and traders are heading out to the beaches for a break. There is just one thing to worry about: Jackson Hole. The Wyoming resort plays host to the annual central bankers' schmoozefest and will include Federal Reserve Chair Jerome Powell among its attendees. The conference takes place as stocks hover near record levels, and Trump continues to take pot-shots at Powell.

Jackson Hole has the potential to be disruptive. Any hint from Powell that a September rate cut isn't happening and markets could sell off hard, while an overly upbeat tone from the Fed chair may feed more euphoria. “And bull markets die in euphoria,” says Steve Sosnick, strategist at trading firm IBKR.

3/ STAGFLATION NATION

As global stocks rally, everything from weak U.S. jobs data to trouble at the top of the Federal Reserve has been a reason to bet on U.S. rate cuts, meaning it's not been profitable to be bearish. About 60% of global investors surveyed by BofA think U.S. stagflation could be the dominant global market regime within three months.

A basket of stocks that do well in stagflationary environments, where growth slows as inflation accelerates, has been outpaced by Wall Street's benchmark S&P 500 index .SPX this year, Societe Generale strategists reckon. Next week's business surveys, which can show economic trends months before they appear in official data, will offer more clues about whether U.S. tariffs are driving the world's largest towards stagflation. SocGen, however, expects Fed rate cuts to inflate a stock-market bubble that might not pop until at least

next year.

4/ OUTLIER

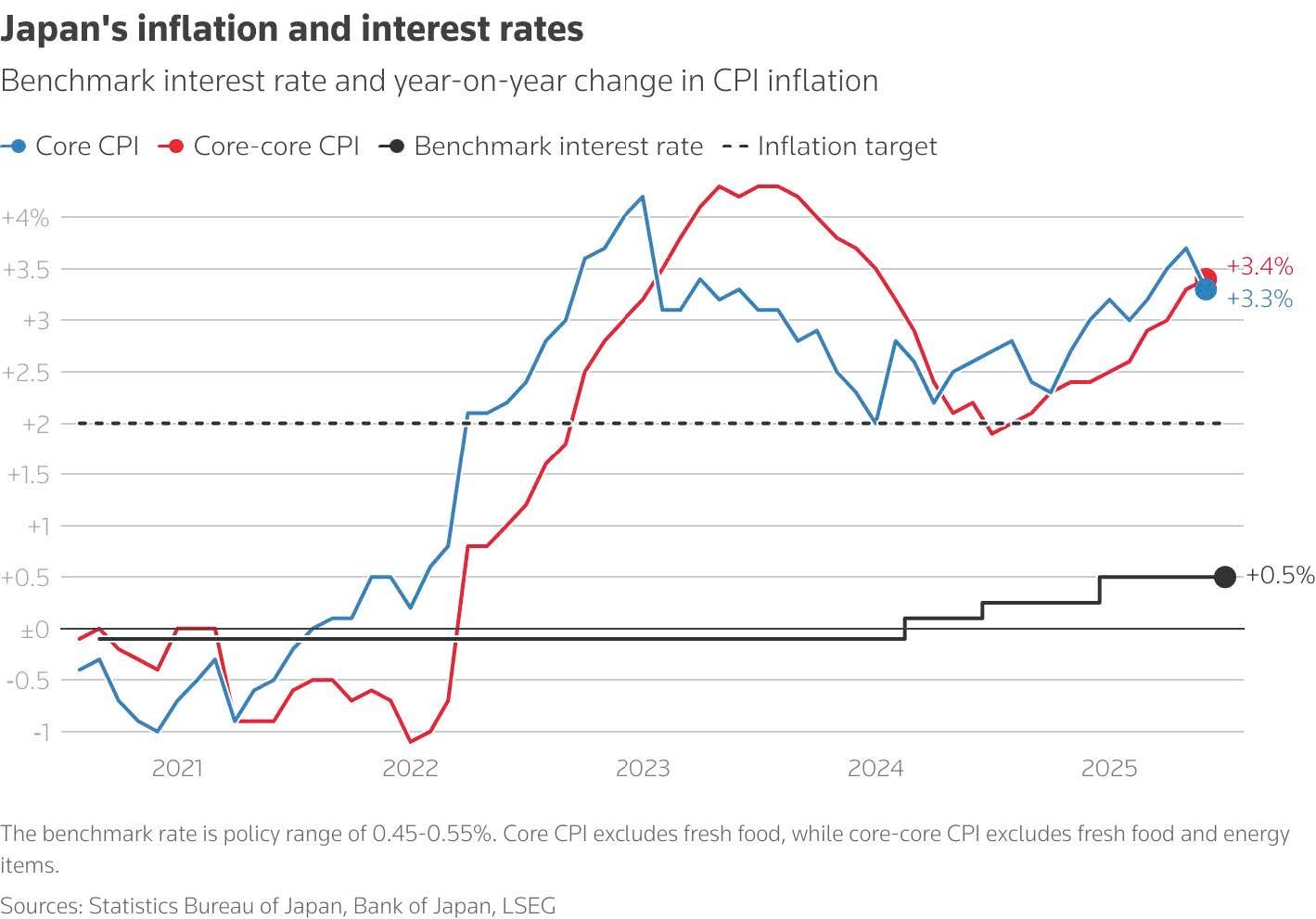

With nearly every central bank looking to cut rates to give their economies a soft landing, the Bank of Japan stands apart in its mission to raise borrowing costs - in theory. So, next Friday's inflation data will be in focus for any sign of when the BOJ's long-pledged tightening cycle will resume.

The previous reading of the core consumer price index (CPI) showed an annual 3.3% increase in June, remaining above the BOJ's 2% target for over three years. No bank went harder or longer with quantitative easing than the BOJ. But the long road towards normalisation has been complicated by uncertainty over U.S. tariffs and concerns about whether Japan was seeing the right kind of price increases. BOJ Governor Kazuo Ueda has justified slower rate hikes because underlying inflation, which focuses on domestic demand and wages, remains below the central bank's target.

5/ PICK ME

Centrist senator Rodrigo Paz was leading Bolivia's presidential election late on Sunday. The election kicks off a string of national and local votes across Latin America that extends into late next year, when behemoth Brazil votes to elect a new (or sitting) president. After 2022's "pink tide" brought left leaning governments to power in Chile, Colombia and Brazil, investors want to see if voters will return to more market-friendly right-wingers.

Ahead of the Bolivian election, the country's bonds rallied on hopes that political change could bring the economy back from the brink. Argentina's local elections in September and October are seen as a gauge of the popularity of President Javier Milei's radical economic transformation. Chile votes for a president in November, while next year Colombia elects its congress in March and

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post