Weekly Economics Report - Aug. 25, 2025

Take Five: Did you say sell tech?

Aug 22 (Reuters) - Nvidia earnings are in the spotlight as pressure on tech stocks rises, while Ukraine and political developments in Japan could also grab attention.

Here's what coming up in the week ahead in financial markets from Lewis Krauskopf and Suzanne McGee in New York, Kevin Buckland in Tokyo, Dhara Ranasinghe in London and Libby George in Minneapolis.

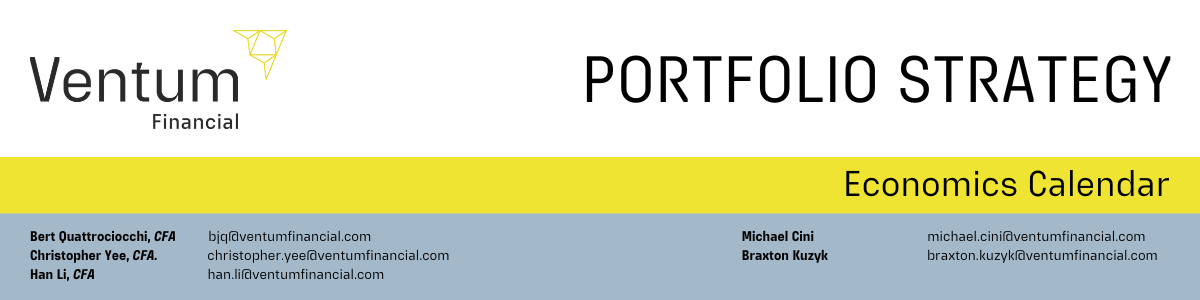

1/ NVIDIA NEXT

Nvidia's August 27 earnings report takes on greater significance after tech shares stumbled this week on some caution over the AI boom. Its dominant position in AI chips has led to another soaring performance in 2025. Last month, it became the first company to top $4 trillion in market value. Any commentary from the AI bellwether related to demand and spending could have broad ramifications for companies exposed to the technology.

Focus could also fall on Nvidia's deal with the Trump administration, which gives the U.S. government 15% of revenue from sales of some advanced chips in China. U.S. Commerce Secretary Howard Lutnick is looking into the government taking equity stakes in Intel and other chipmakers in exchange for grants under a federal act that aims to spur factory-building in the and other chipmakers in exchange for grants under a federal act that aims to spur factory-building in the U.S., sources say.

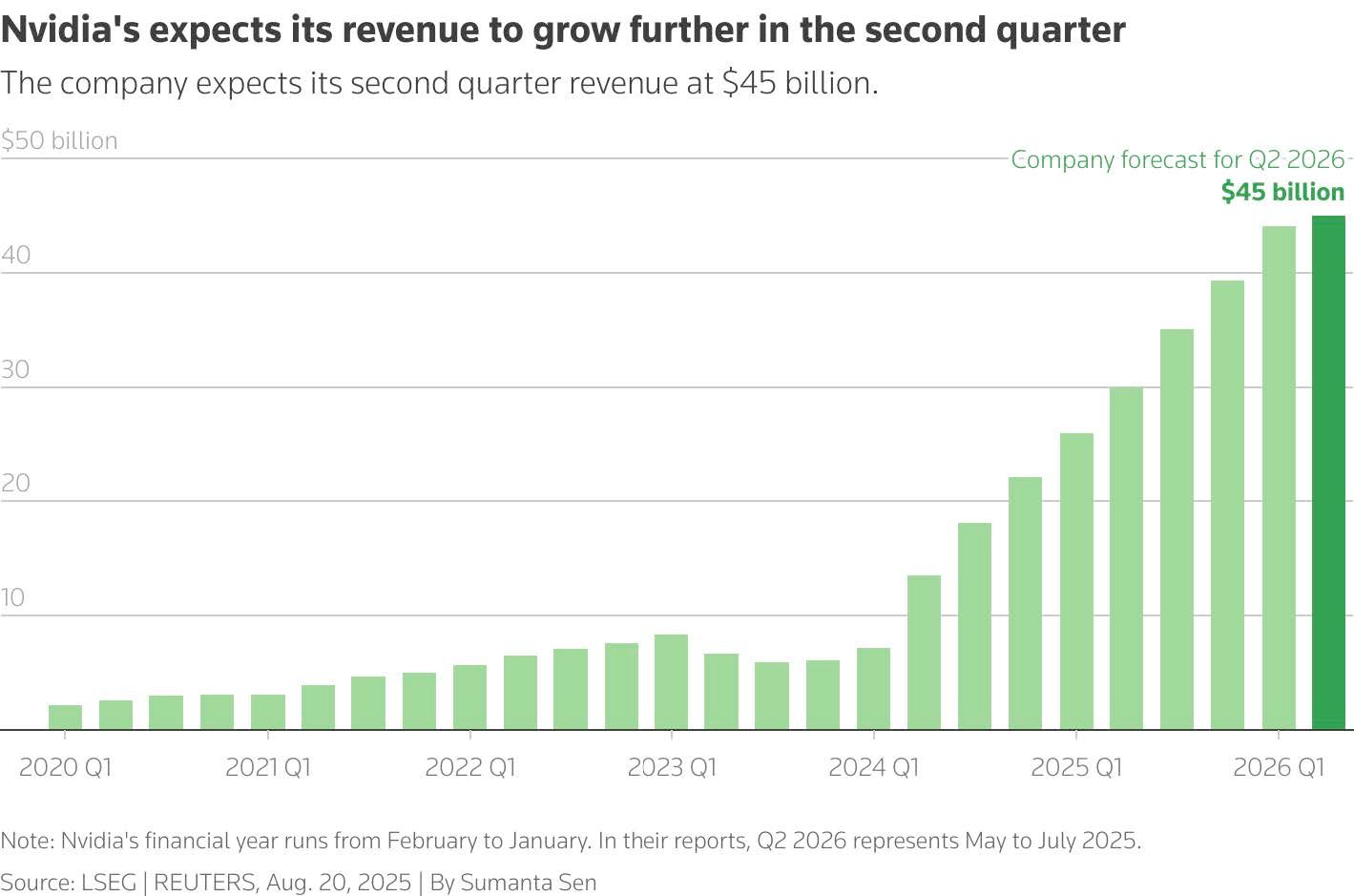

2/ PRICING IN PEACE

Global defence stocks took a beating on signs that peace could return to Ukraine, although geopolitical analysts caution that it is far too soon to start pricing in a "peace dividend". The sector has been on a tear for most of 2025, as conflicts in the Middle East and Ukraine, and U.S. pressure, prompt governments to bump up defence spending.

That has helped propel stocks like U.S.-based RTX Corp RTX.N, the parent company of defence contractor Raytheon, roughly 35% higher so far this year. The S&P 500 is up 9% .SPX. Germany's Rheinmetall has surged 160% RHMG.DE and Italian aerospace giant Leonardo S.p.A. LDOF.MI is still up 73% even after this week's selloff.

A de-escalation in the war in Ukraine could prompt further selling but not much given the global great power play taking place, strategists say. Given that most countries are viewed as "behind the curve" on defence spending, the sector will remain

in favour.

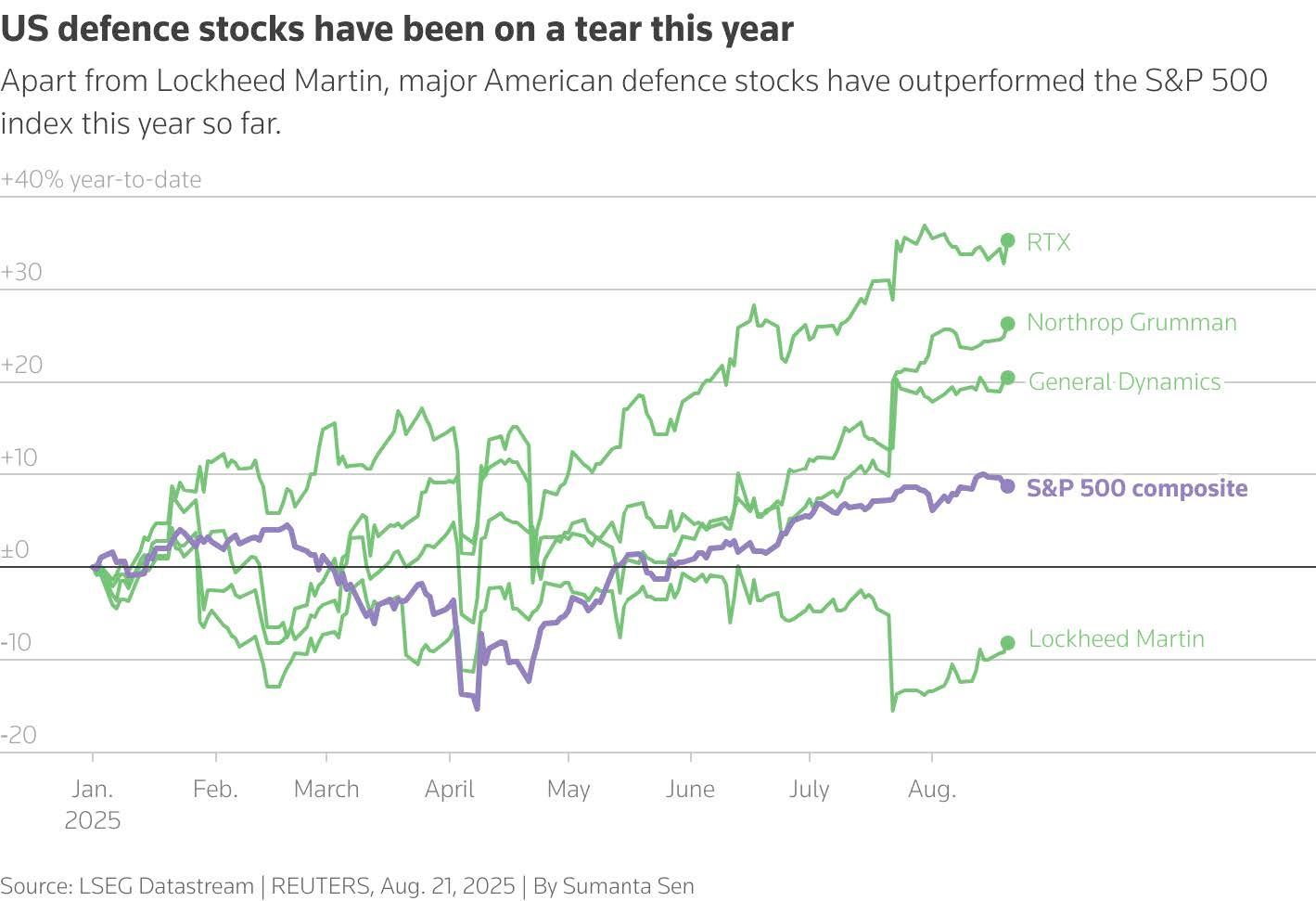

3/ EXIT STRATEGY

Political paralysis in Japan is putting pressure on the bond market, with 10-year bond yields hitting the highest since 2008, and 30-year yields at all-time peaks. Calls continue for Prime Minister Shigeru Ishiba to step down following a bruising loss in recent upper house elections, but his refusal has kept worries alive about a loosening of fiscal restraint to cater to upand- coming opposition parties.

Things could come to a head next week, with Ishiba's ruling Liberal Democratic Party due to release a fact-finding report on the reasons for the poor poll showing by month-end. Some observers reckon this could provide the timing for a graceful exit, as it also allows Ishiba to clear key diplomatic meetings with South Korea's leader this weekend and India's Narendra Modi a week later.

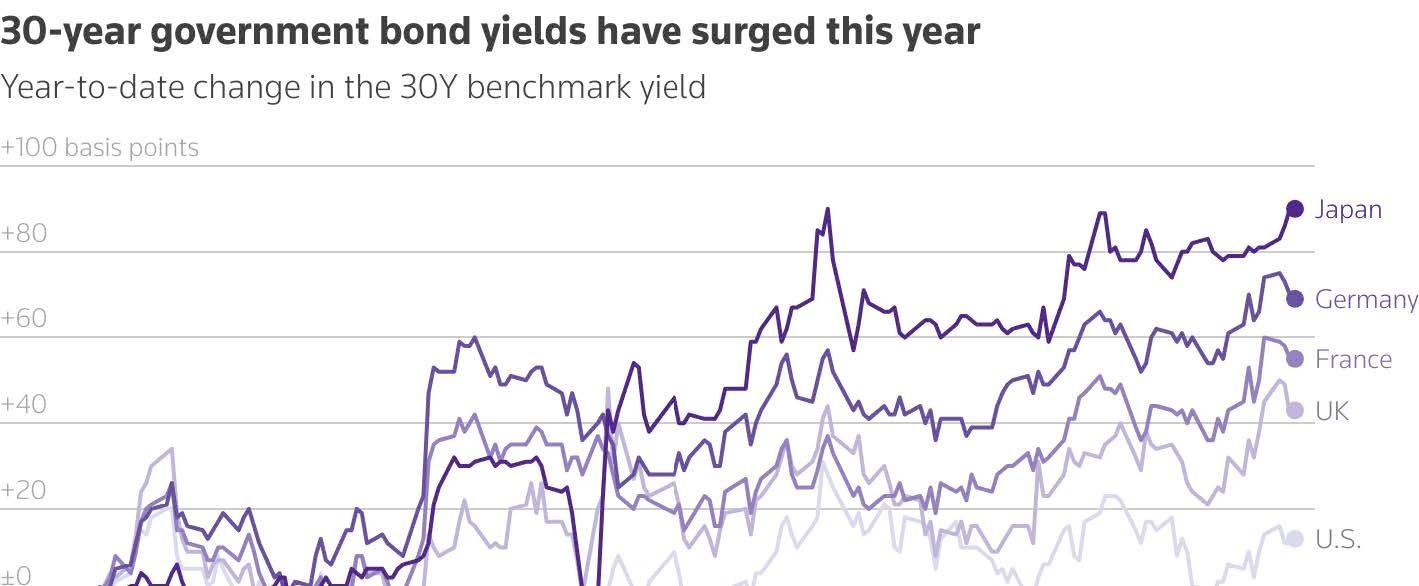

4/ WATCHING MR. BOND

As the tech selloff grabbed headlines, renewed pressure in bond markets went a little under the radar. German and French 30-year bond yields this week rose to their highest since 2011, Japanese yields are at their highest in years, UK long-dated bonds sold off again and U.S. 30-year yields are hovering near 5%.

Sure, the reasons behind the selling are well established: debt levels are rising, so governments need to sell more bonds. Some such as Japan need to hike rates, others including the U.S. and UK face still sticky inflation.

Some reckon that fast-money types could be starting to position for a crisis. That the selling pressure on bonds continues is, in itself, a worry for governments now forking out meaningful amounts of their income on debt service payments. The selloff could be a harbinger of what comes in September when supply picks up.

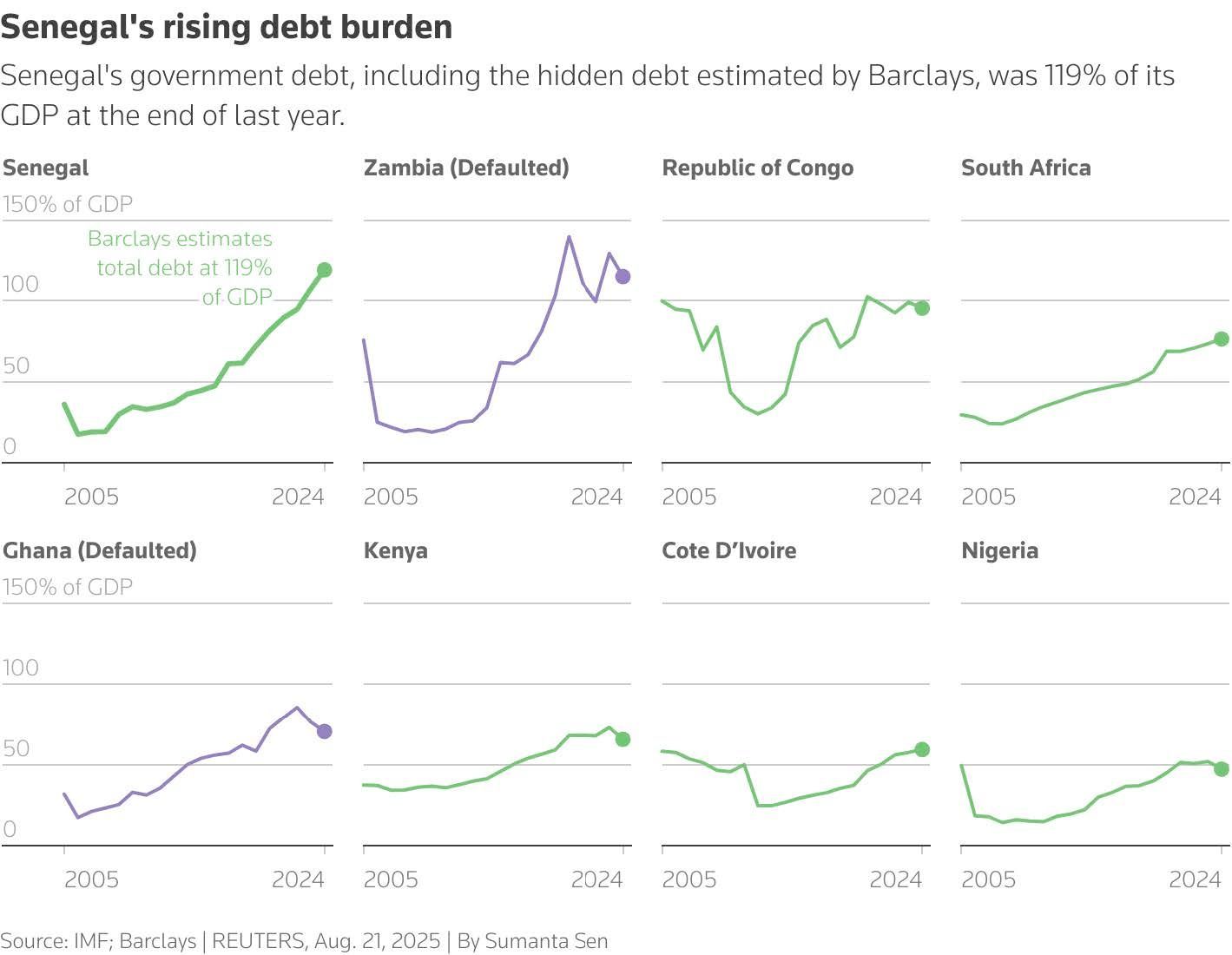

5/ HIDE AND SEEK

West Africa's Senegal awaits the results of an International Monetary Fund mission, concluding on Tuesday, to unpick its mammoth hidden debts and move forward. The scale of the hidden debts, which the IMF pegs at $11.3 billion, has ballooned since September 2024, when its then-new leaders first flagged the issue. Note, Mozambique's “tuna bond” hidden debt scandal tallied up to just a few billion.

Investors are watching. A communique could shed light on what the IMF does next, after pushing for better debt reporting across emerging markets for years. Senegal's scandal is a black eye for the Fund, since it had a monitoring programme at the time. The IMF must now balance the need to show consequences for misreporting while avoiding punishing Senegal for openness. Investors hope the Fund will move forward with a long-awaited misreporting waiver after the mission, paving the way for a new programme. Without a waiver, Senegal could have to repay.

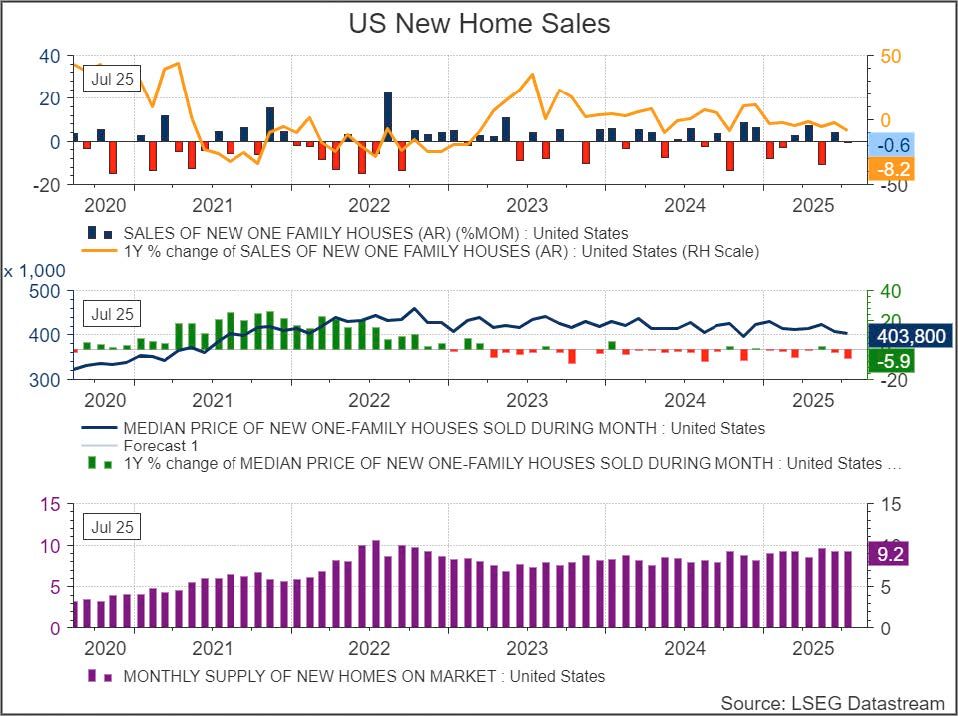

MONTHLY NEW RESIDENTIAL SALES, JULY 2025

August 25, 2025 - The U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced the following new residential sales statistics for July 2025:

New Home Sales

Sales of new single-family houses in July 2025 were at a seasonally-adjusted annual rate of 652,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.6 percent (±15.5 percent)* below the June 2025 rate of 656,000, and

is 8.2 percent (±14.0 percent)* below the July 2024 rate of 710,000.

For Sale Inventory and Months’ Supply

The seasonally-adjusted estimate of new houses for sale at the end of July 2025 was 499,000. This is 0.6 percent (±1.2 percent)* below the June 2025 estimate of 502,000, and is 7.3 percent (±5.7 percent) above the July 2024 estimate of 465,000. This represents a supply of 9.2 months at the current sales rate.

The months' supply is virtually unchanged (±16.7 percent)* from the June 2025 estimate of 9.2 months, and is 16.5 percent (±19.0 percent)* above the July 2024 estimate of 7.9 months.

Sales Price

The median sales price of new houses sold in July 2025 was $403,800. This is 0.8 percent (±5.9 percent)* below the June 2025 price of $407,200, and is 5.9 percent (±8.5 percent)* below the July 2024 price of $429,000. The average sales price of new houses sold in July 2025 was $487,300. This is 3.6

percent (±8.0 percent)* below the June 2025 price of $505,300, and is 5.0 percent (±8.6 percent)* below the July 2024 price of $513,200.

Source: US Census Bureau

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post