Weekly Economics Report - Jan 10, 2026

US Consumer Sentiment Rises Slightly in January

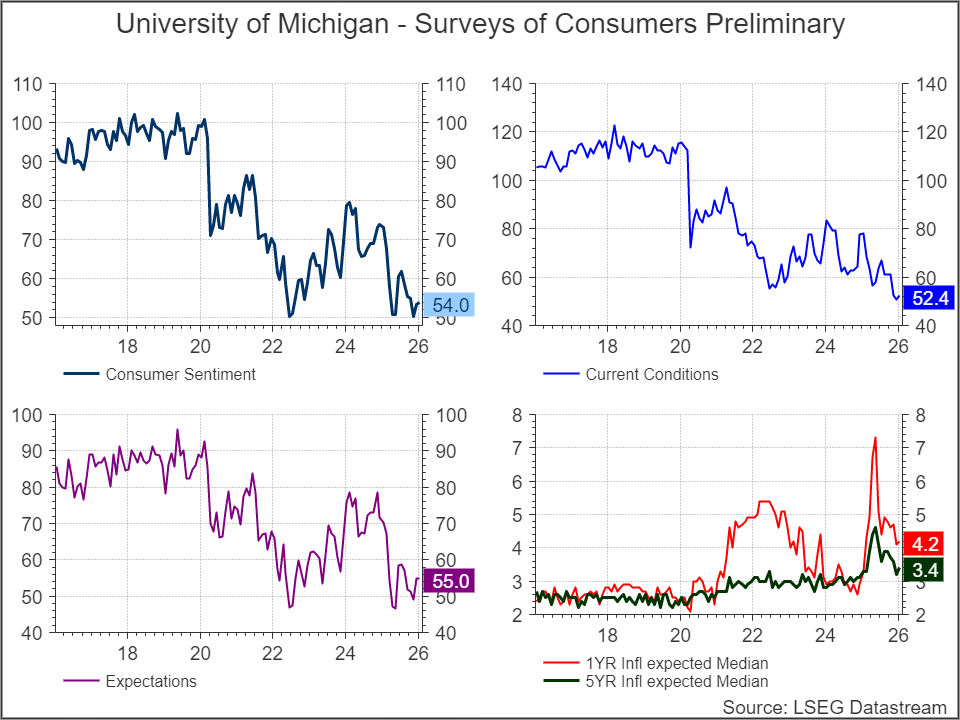

The University of Michigan’s consumer sentiment index inched up for the second consecutive month, rising to 54.0 in January 2026, its highest level since September 2025 and slightly above market expectations of 53.5, according to a preliminary estimate.

Gains were concentrated among lower-income consumers, while sentiment among higher-income households slipped. Overall, US households reported modest improvement in economic perceptions over the past two months, but sentiment remains nearly 25% below January 2025 levels. Consumers continue to worry about high prices and a softening labor market, though concerns about tariffs appear to be gradually easing. Year-ahead inflation expectations held steady at 4.2%, the lowest since January 2025, yet still well above the 3.3% recorded a year ago. Meanwhile, long-term inflation expectations ticked up slightly, rising to 3.4% from 3.2% in December.

Source: Trading economics

US job growth slows in December; unemployment rate eases to 4.4%

WASHINGTON, Jan 9 (Reuters) - U.S. job growth slowed more than expected in December amid business caution about hiring because of import tariffs and rising artificial intelligence investment, but the unemployment rate dipped to 4.4%, supporting expectations the Federal Reserve would leave interest rates unchanged this month.

Nonfarm payrolls increased by 50,000 jobs last month after rising by a downwardly revised 56,000 in November, the Labor Department's Bureau of Labor Statistics said on Friday. Economists polled by Reuters had forecast 60,000 jobs added after a previously reported 64,000 increase in November.

The closely watched employment report suggested the labor market remained stuck in what economists and policymakers have called a "no hire, no fire" mode. It also confirmed the economy was in a jobless expansion. Economic growth and worker productivity surged in the third quarter, in part attributed to the AI spending boom.

The labor market lost considerable momentum last year, largely blamed on President Donald Trump's aggressive trade and immigration policies, which economists and policymakers said reduced both demand for and supply of workers.

The sharp moderation in job growth, however, started in 2024. The BLS has estimated about 911,000 fewer jobs were created in the 12 months through March 2025 than previously reported. The agency will publish its payrolls benchmark revision next month with the January employment report. The overcounting has been blamed on the birth-death model, which is used by the BLS to estimate how many jobs were gained or lost because of companies opening or closing in a given month. Last month, the BLS said it would, starting in January, change the birth-death model by incorporating current sample information each month.

Together with the December employment report, the BLS published annual revisions to the household survey data for the past five years. The unemployment rate is calculated from the household survey.

The annual population control adjustments, normally incorporated with the January employment report, will be delayed. November's unemployment rate was revised down to 4.5% from the previously reported 4.6%. The median forecast in a Reuters poll of economists was for the jobless rate to have eased to 4.5% in December. Some economists say low supply has prevented a sharp rise in the unemployment rate. They estimated that between 50,000 and 120,000 jobs need to be created each month to keep up with growth in the working-age population.

The U.S. central bank cut its benchmark interest rate by a quarter of a percentage point to the 3.50%-3.75% range in December, but officials indicated they were likely to pause further reductions in borrowing costs for now to get a better sense of the economy's direction.

With factors like tariffs and AI preventing companies from hiring more workers, economists increasingly view the labor market's challenges as more structural than cyclical, which would make rate cuts less effective to stimulate job growth.

Canada job creation pauses after hiring surge, unemployment rate rises

OTTAWA, Jan 9 (Reuters) - Canada created just 8,200 net new jobs in December after three months of outsize gains and the unemployment rate rose to 6.8% from 6.5% as more people searched for work, Statistics Canada said on Friday.

Analysts polled by Reuters had expected a net loss of 5,000 positions and the jobless rate to edge up to 6.6%.

The Canadian dollar dipped to C$1.3880 to the U.S. dollar, or 72.05 U.S. cents, from C$1.3873, or 72.08 cents.

The economy had added a total of 181,000 new jobs from September through November, in contrast to almost no change in the first eight months when U.S. tariffs and trade uncertainty choked hiring.

There were 1.55 million people unemployed in December, an increase of 72,900, or 4.9%, from November.

"With more people once again looking for work, today's unemployment rate suggests that plenty of slack remains in the labor market," said Andrew Grantham, a senior economist at CIBC Capital Markets.

Full-time employment rose by 50,200 in December while part-time employment fell by 42,000.

Employment in health care and social assistance in December increased by 20,800 while the professional, scientific and technical services sector posted a drop of 18,100 positions, the first decrease since August. People aged from 15 to 24 have been hard hit by the economic uncertainty. After posting successive gains in October and November, the first advances since the start of the year, youth employment dipped by 1.0%. The average hourly wage of permanent employees - a gauge closely tracked by the Bank of Canada to ascertain inflationary trends - rose by 3.7%, down from 4.0% in November.

The Bank held its key policy rate steady at 2.25% on December 10 and said this was about the right level to keep inflation close to the 2% target. Money markets expect rates to stay on hold for the rest of the year.

"While hiring was soft and the unemployment rate rose, the survey wasn't weak enough to alter expectations for the Bank of Canada," Desjardins macro strategy head Royce Mendes said in a note.

US single-family housing starts rebound in October, building permits dip

WASHINGTON, Jan 9 (Reuters) - U.S. single-family homebuilding rebounded in October, but permits for future construction eased, signaling caution among builders as new housing inventory remains high and demand soft.

Single-family housing starts, which account for the bulk of homebuilding, increased 5.4% to a seasonally adjusted annual rate of 874,000 units in October, the Commerce Department's Census Bureau said on Friday. Starts dropped to a pace of 829,000 units in September from a 869,000-unit pace in August.

The reports were delayed by the 43-day government shutdown. Builders are also being constrained by higher building and labor costs because of import tariffs and an immigration crackdown.

Permits for future single-family homebuilding fell 0.5% to a rate of 876,000 units in October. They increased to a pace of 880,000 units in September from a 858,000-unit rate in August.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post