Weekly Economics Report - June 28, 2025

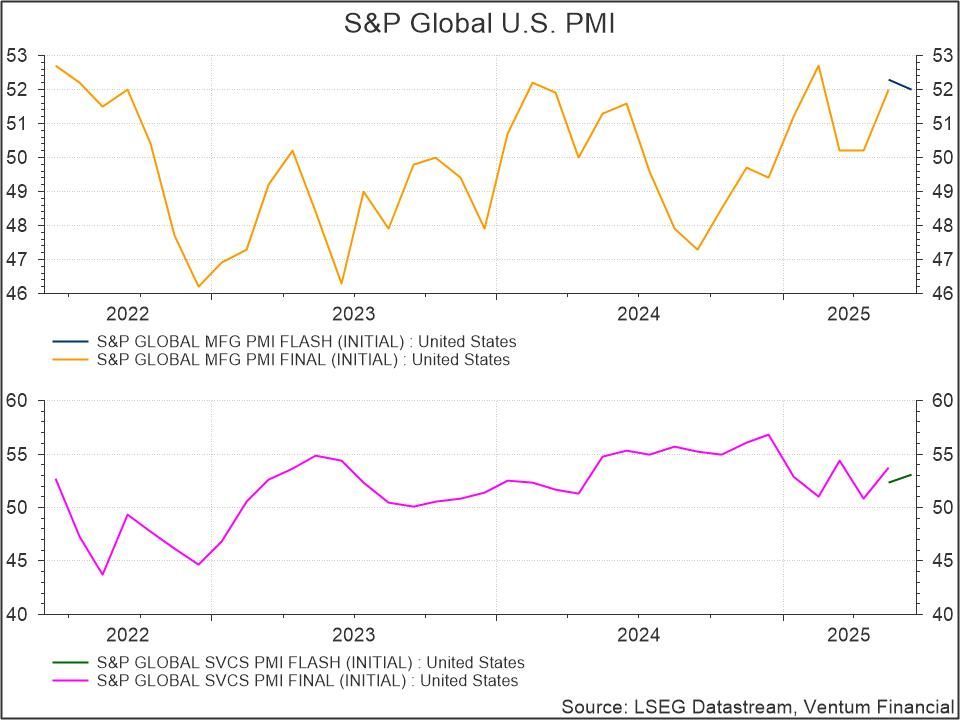

US business activity moderates; price pressures building up

WASHINGTON, June 23 (Reuters) - U.S. business activity slowed marginally in June, though prices increased further amid President Donald Trump's aggressive tariffs on imported goods, suggesting that an acceleration in inflation was likely in the second half of the year.

That supports economists' expectations that inflation would surge from June following mostly benign consumer and producer price readings in recent months. Economists have argued that inflation has been slow to respond to Trump's sweeping import duties because businesses were still selling stock accumulated before the tariffs came into effect.

S&P Global's flash U.S. Composite PMI Output Index, which tracks the manufacturing and services sectors, slipped to 52.8 this month from 53.0 in May. A reading above 50 indicates expansion in the private sector.

The survey's flash manufacturing PMI was unchanged at 52.0. Economists polled by Reuters had forecast the manufacturing PMI easing to 51.0. Its flash services PMI dipped to 53.1 from 53.7 in May. Economists had forecast the services PMI falling to 53.0. The survey was conducted in the June 12-20 period, before the U.S. joined in the conflict between Israel and Iran.

"The June flash PMI data indicated that the U.S. economy continued to grow at the end of the second quarter, but that the outlook remains uncertain while inflationary pressures have risen sharply in the past two months," said Chris Williamson, chief business economist at S&P Global Market Intelligence.

So-called hard data on retail sales, housing and the labor market have painted a picture of an economy that was softening because of the uncertainty caused by the constantly shifting tariffs policy. The escalation in tensions in the Middle East added another layer of uncertainty.

INFLATION POISED TO ACCELERATE

The S&P Global survey's measure of new orders received by businesses declined to 52.3 from 53.0 in May. A measure of prices paid by businesses for inputs fell to 61.6 from 63.2 last month. But manufacturers faced higher input costs, with this price gauge jumping to 70.0 this month. That was the highest reading since July 2022 and followed 64.6 in May.

Prices paid for inputs by services businesses remained elevated, with tariffs, higher financing, wage and fuel costs cited. The pace of increase, however, slowed amid competition.

The survey's measure of prices charged by businesses for goods and services remained at lofty levels as manufacturers passed on the increased costs from tariffs to consumers. The prices charged gauge for manufacturers shot up to 64.5, the highest since July 2022, from 59.7 in May.

Rising oil prices because of the strife in the Middle East are seen contributing to higher inflation.

The Federal Reserve last week kept the U.S. central bank's benchmark overnight interest rate in the 4.25%-4.50% range, where it had been since December. Fed Chair Jerome Powell told reporters he expected "meaningful" inflation ahead. "The data therefore corroborate speculation that the Fed will remain on hold for some time to both gauge the economy's resilience and how long this current bout of inflation lasts for," Williamson said.

Employment picked up this month, mostly driven by manufacturing, where some factories are experiencing order backlogs. S&P Global noted a slight rise in optimism among manufacturers "in part reflecting hopes of greater benefits from trade protectionism." It, however, added that "companies generally remained less upbeat than prior to the inauguration of President Trump."

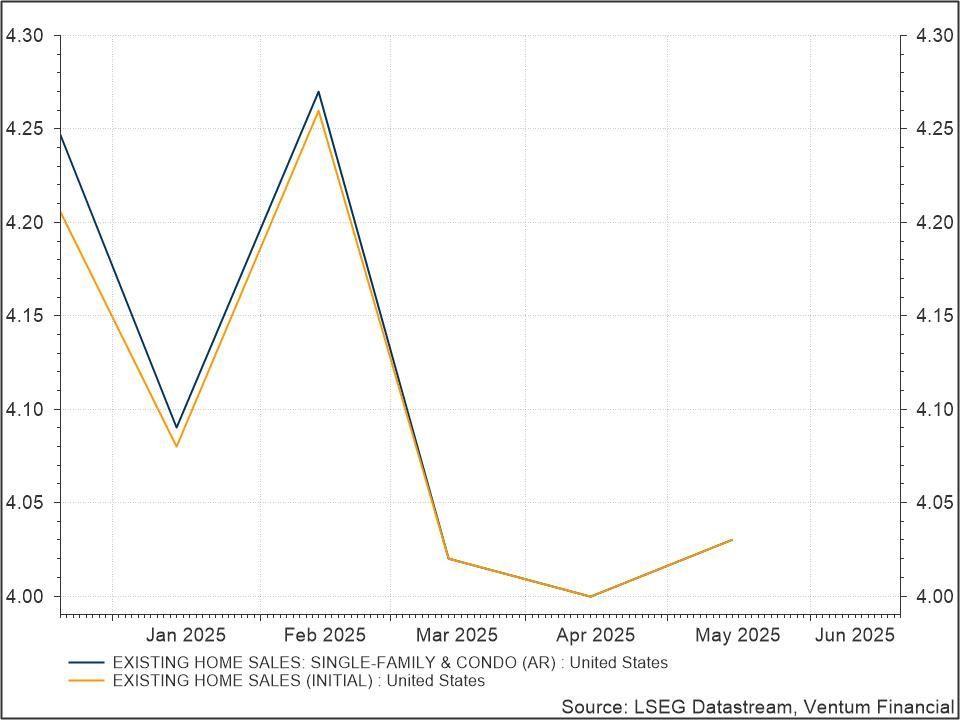

US existing home sales rise in May; mortgage rates still a constraint

WASHINGTON, June 23 (Reuters) - U.S. existing home sales unexpectedly increased in May, but the trend remained weak amid high mortgage rates.

Home sales climbed 0.8% last month to a seasonally adjusted annual rate of 4.03 million units, the National Association of Realtors said on Monday. Economists polled by Reuters had forecast home resales falling to a rate of 3.95 million units.

The sales pace was the slowest for the month of May since 2009.

Sales fell 0.7% on a year-over-year basis in May.

"The relatively subdued sales are largely due to persistently high mortgage rates," said Lawrence Yun, the NAR's chief economist. "If mortgage rates decrease in the second half of this year, expect home sales across the country to increase."

The average rate on the popular 30-year fixed-rate mortgage has hovered just under 7% this year. President Donald Trump's aggressive tariffs on imported goods have heightened uncertainty over the economy, which the Federal Reserve has responded to by pausing its interest rate cutting cycle.

The U.S. central bank last week kept its benchmark overnight interest rate in the 4.25%-4.50% range, where it has been since December. Fed Chair Jerome

Powell told reporters he expected "meaningful" inflation ahead due to the import duties.

A National Association of Home Builders survey on Tuesday showed sentiment among single-family homebuilders plummeted to a 2-1/2-year low in June. The NAHB reported an increase in the share of builders cutting prices to lure buyers, and forecast a decline in single-family starts this year. Residential investment, which includes homebuilding and home sales, contracted slightly in the first quarter after rebounding in 2024 following steep declines in the prior two years caused by a surge in mortgage rates.

The inventory of existing homes increased 6.2% to 1.54 million units in May. Supply surged 20.3% from a year ago. The median existing home price rose 1.3% from a year earlier to $422,800 in May, an all-time high for the month. At May's sales pace, it would take 4.6 months to exhaust the current inventory of existing homes, up from 3.8 months a year ago. A four-to-seven-month supply is viewed as a healthy balance between supply and demand.

Properties typically stayed on the market for 27 days last month compared to 24 days a year ago. First-time buyers accounted for 30% of sales, down from 31% a year ago. Economists and realtors say a 40% share is needed for a robust housing market. All-cash sales constituted 27% of transactions, down from 28% a year ago. Distressed sales, including foreclosures, made up 3% of transactions, up from 2% a year ago.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post