Weekly Economics Report - June 20, 2025

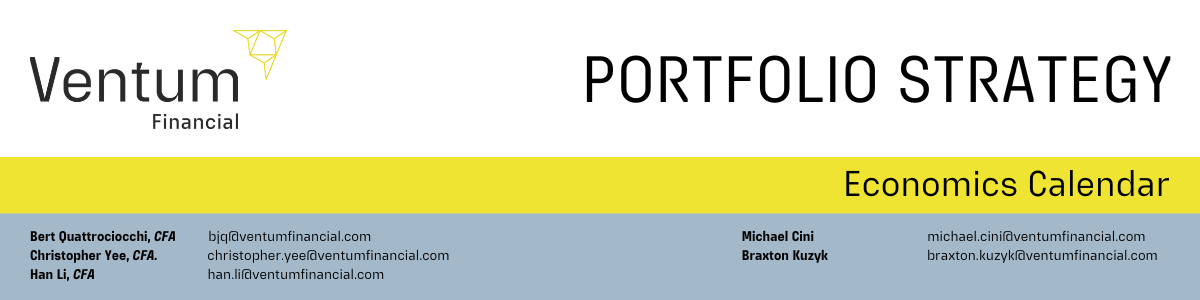

Canadian housing starts largely flat in May from April - CMHC

OTTAWA, June 16 (Reuters) - Canadian housing starts were largely flat in May compared with April as a slight rise in groundbreaking in multiple unit urban homes was offset by a marginal drop in starts in single-family detached urban homes, national housing agency data showed on Monday.

The seasonally adjusted annualized rate of housing starts was down 0.2% at 279,510 units from a revised 280,181 units in April, the Canadian Mortgage and Housing Corporation (CMHC) said. Economists had expected starts to fall to 247,500 units last month.

China’s factories slow, consumers unexpectedly perk up

BEIJING, June 16 (Reuters) - China's factory output growth hit a six-month low in May, while retail sales picked up steam, offering temporary relief for the world's second-largest economy amid a fragile truce in its trade war with the United States.

The mixed data comes as China's economy strains under U.S. President Donald Trump's tariff onslaught and chronic weakness in the property sector, with entrenched home price declines showing no signs of reversing. Industrial output grew 5.8% from a year earlier, National Bureau of Statistics data showed on Monday, slowing from 6.1% in April and missing expectations for a 5.9% rise in a Reuters poll of analysts. It was the slowest growth since November last year. However, retail sales rose 6.4%, much quicker than a 5.1% increase in April and forecasts for a 5.0% expansion, marking the fastest growth since December 2023. All up, the numbers failed to convince investors or analysts that anaemic growth would pick up anytime soon with Chinese blue chips .CSI300 erasing very brief gains on Monday.

"The U.S.-China trade truce was not enough to prevent a broader loss of economic momentum last month," Zichun Huang, China Economist at Capital Economics, said. "With tariffs set to remain high, fiscal support waning and structural headwinds persisting, growth is likely to slow further this year."

Data released earlier this month showed China's total exports expanded 4.8% in May, but outbound shipments to the U.S. plunged 34.5%, the sharpest drop since February 2020.

The Asian giant's deflationary pressures also deepened last month.

Supporting retail sales were strong Labour Day holiday spending and a consumer goods trade-in programme that was heavily subsidised by the government. An extended "618" shopping festival, one of China's largest online retail events by sales, started earlier than usual this year, helping lift consumption.

CAUTION AHEAD

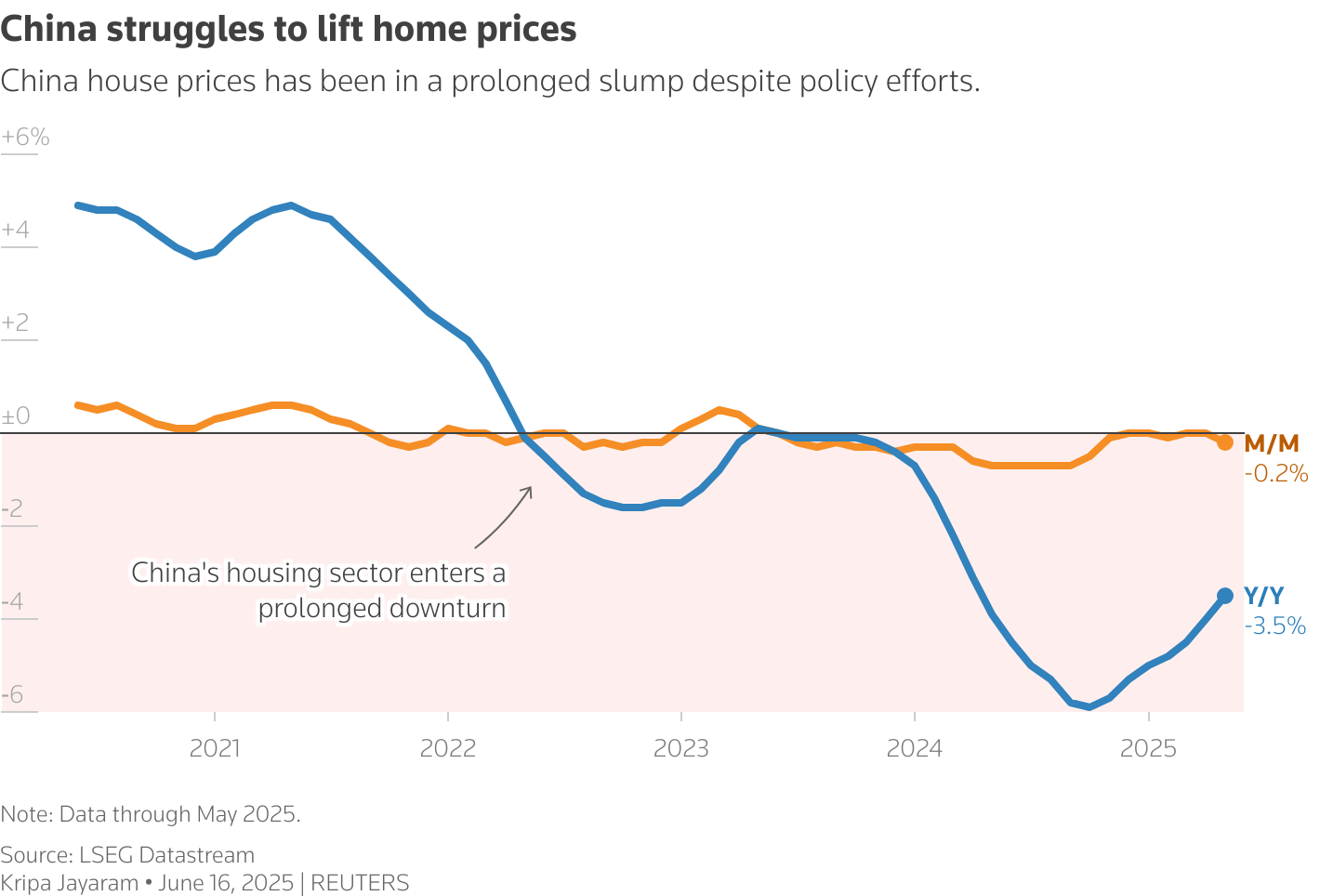

Overhanging the activity indicators were persistent headwinds in China's housing sector, with new home prices extending two years of stagnation.

"We find a general pattern that wherever there is stimulus, it works, like the home appliance sales; but wherever there is no stimulus, like the property development, it struggles," said Tianchen Xu, senior economist at the Economist Intelligence Unit.

"There are reasons for more caution going forward, especially regarding private consumption which could see a 'triple whammy' of tightening dining curbs on officials, the end of a front-loaded 618 shopping festival and the suspension of government consumer subsidies." Fixed asset investment expanded 3.7% in the first five months of this year from the same period a year earlier, compared with expectations for a 3.9% rise. It grew 4.0% in the January to April period.

Trump last week said a trade deal that restored a fragile truce in the U.S.-China trade war was done, a day after negotiators from Washington and Beijing agreed on a framework covering tariff rates. That means the U.S. will charge Chinese exports a total of 55% tariffs, he said. A White House official said the 55% would include pre-existing 25% levies on imports from China that were put in place during Trump's first term.

For now, trade woes have not been reflected in employment figures with the urban survey-based jobless rate nudging down to 5.0% in May, from 5.1% previously. Beijing last month rolled out a package of stimulus measures, including interest rate cuts and a major liquidity injection, aimed at shielding the economy from the hit from U.S. tariffs. However, analysts continued to flag challenges for China in hitting its growth target of roughly 5% this year and warned imminent stimulus was unlikely.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post