Weekly Economics Report - June 12, 2025

Take Five: It's TACO time

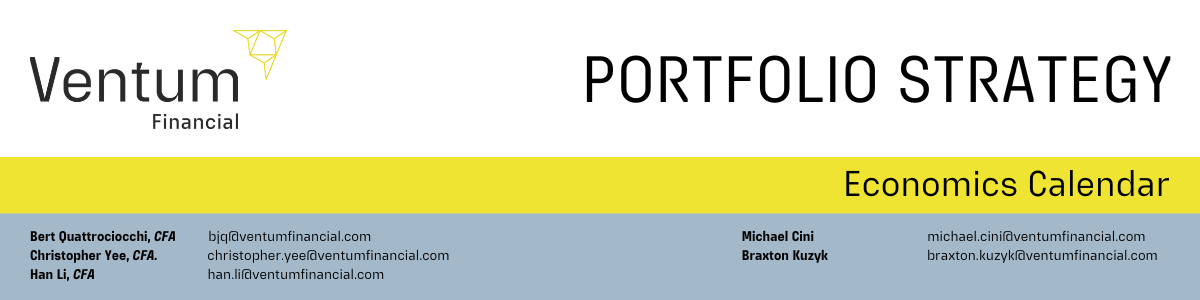

June 6 (Reuters) - Uncertainty from Washington's tariff tactics remains rife, but investors realise that whatever U.S. President Donald Trump threatens doesn't tend to last long before he delays or backs down, meaning recent volatility has ebbed. This tendency to U-turn, dubbed the TACO trade - "Trump Always Chickens Out" - has caught on but it's also given investors something to bank on so they can focus on upcoming reads on inflation and trade.

Here's a look at what's coming up for world markets from Kevin Buckland in Tokyo, Naomi Rovnick and Amanda Cooper in London and Alden Bentley in New York.

1. TACOS FOR BREAKFAST

The high-voltage volatility that shook markets in April and through May has subsided, with investors becoming accustomed to Trump's on-again-off-again approach to anything from tariffs to personal relationships - the meltdown with erstwhile DOGE chief and Tesla Chief Executive Elon Musk being the latest.

Wall Street's fear-gauge, the VIX index, has slipped back below the 20-line that many view as a watermark. Since Trump became the 47th president on January 20, the index has topped 20 on 47 occasions. In the five months prior to that, it breached that level 18 times. In the last month, there have been just seven days when the VIX has popped above 20, compared with every day from April 2 "Liberation Day" to early May.

If anything, the TACO trade is taking some spice out of the market.

2. INFLATION HIDE AND SEEK

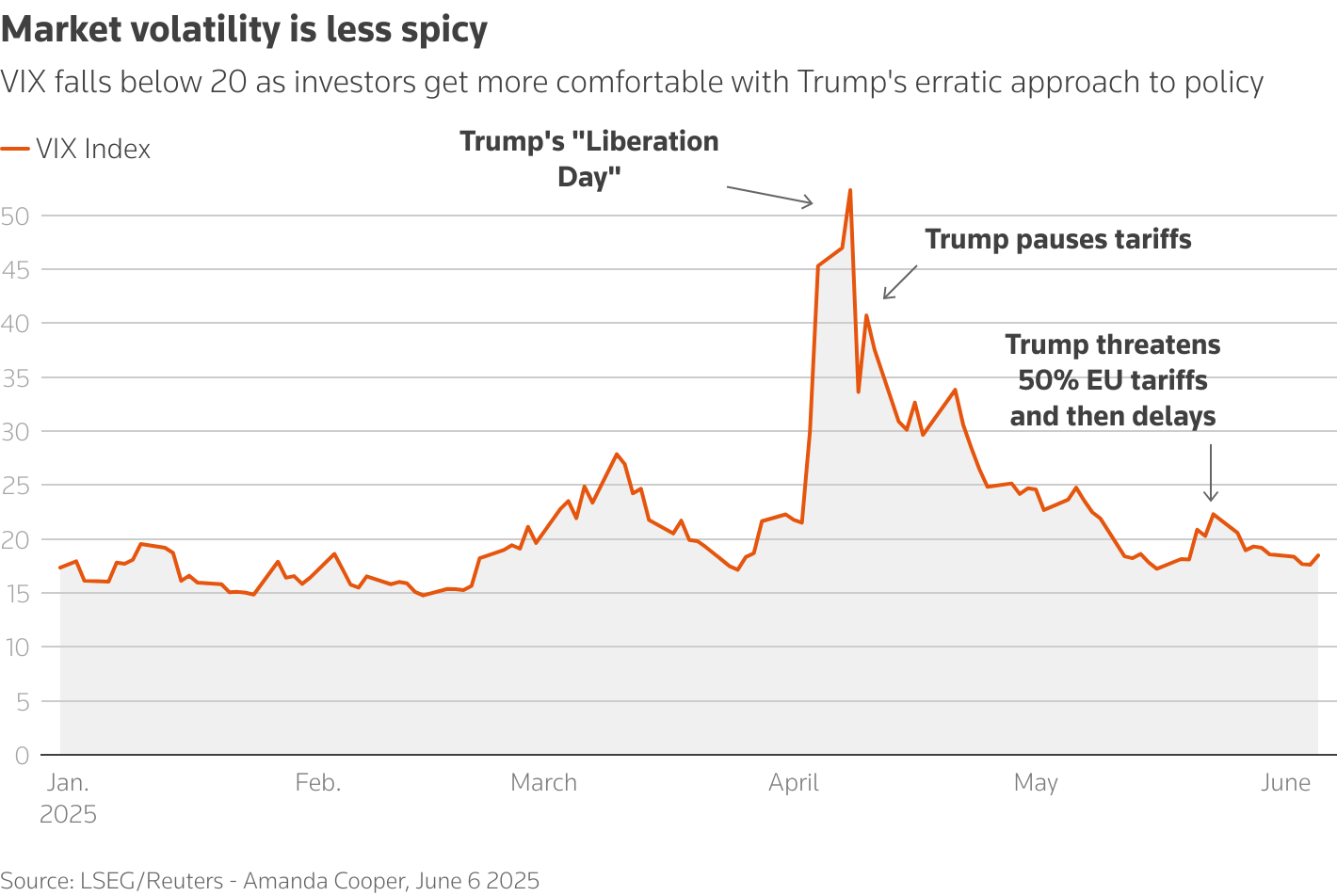

Investors are hoping any rise in Wednesday's May consumer inflation report won't be as severe as feared, given Trump's erratic trade tactics. Recent data shows inflation falling close to the Federal Reserve's 2% target. Price pressures inmanufacturing and services sectors are picking up, however.

A good gauge of markets' long-term inflation view indicates only moderate concern. The inflation breakeven rate on five-year Treasury Inflation Protected Securities US5YTIP=TWEB suggests investors believe the rate will average less than 0.3 percentage points above the target for the next five years.

The Fed's most recent Beige Book showed economic activity is weakening, while costs and prices are rising across the different regions - a combination policymakers do not want to see. Traders expect the Fed to make no rate change at its June 18 meeting.

3. A RARE DISPUTE

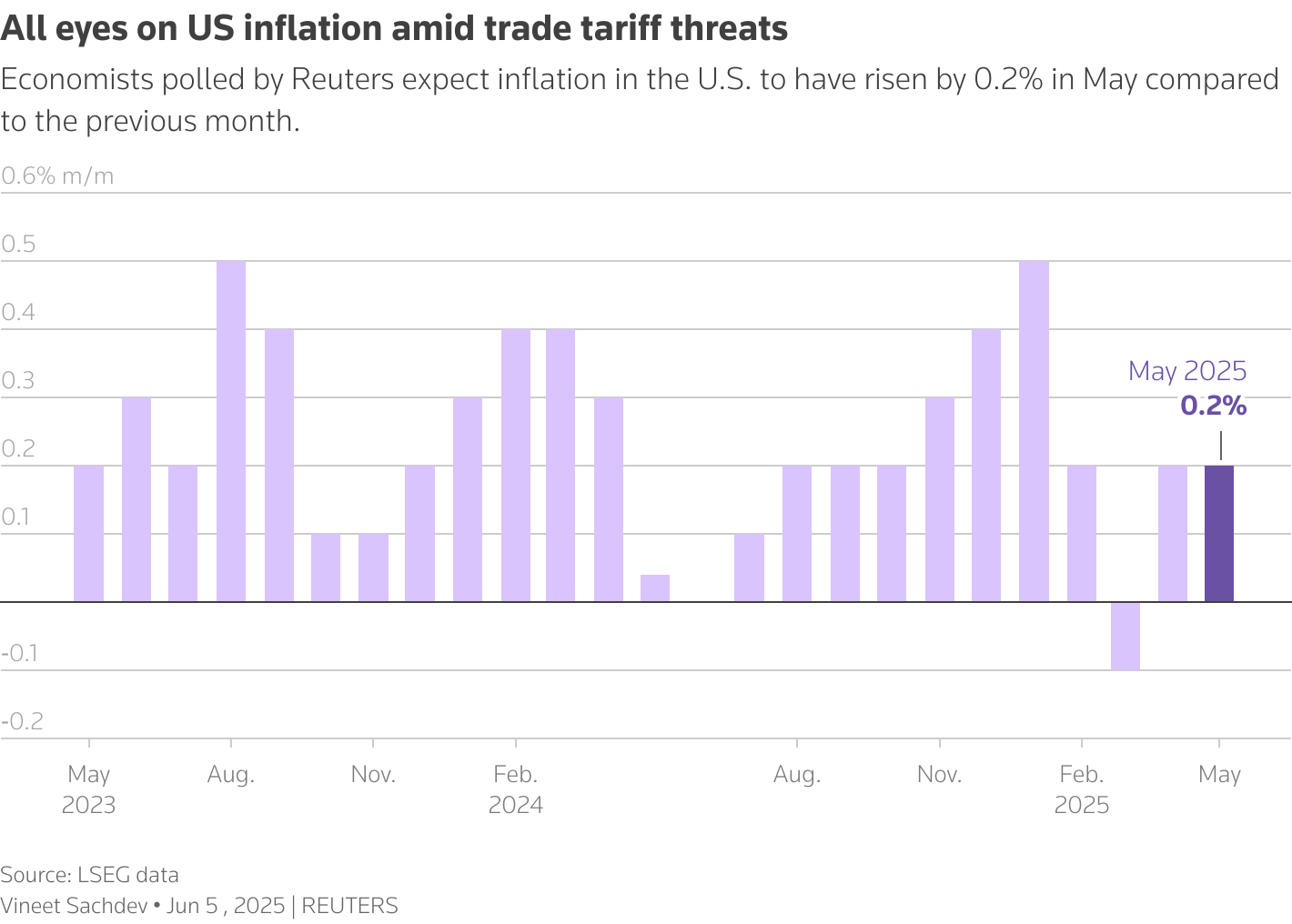

Washington and Beijing's trade spat has brought a familiar issue back to the surface.

China has a stranglehold on global supply of so-called rare earths, critical ingredients in almost every high-tech device out there, from cars to cruise missiles. When China cuts off supply, everything withers.

The auto industry is feeling it. Suzuki7269.T suspended production of the Swift subcompact, weeks after Ford F.N did the same for its Explorer SUV.

The White House has blasted Beijing for reneging on tariff rollbacks agreed in Geneva last month, but China is doing the same, lambasting the U.S. over revoked student visas and cutting-edge chip curbs.

Chinese trade data on Monday will illuminate what's at stake, while inflation figures that day will show if Beijing's efforts to stoke domestic demand are working.

U.S. and Chinese officials are due to meet in London on Monday to discuss trade and defuse the high-stakes dispute.a

4. A NICE BALANCE

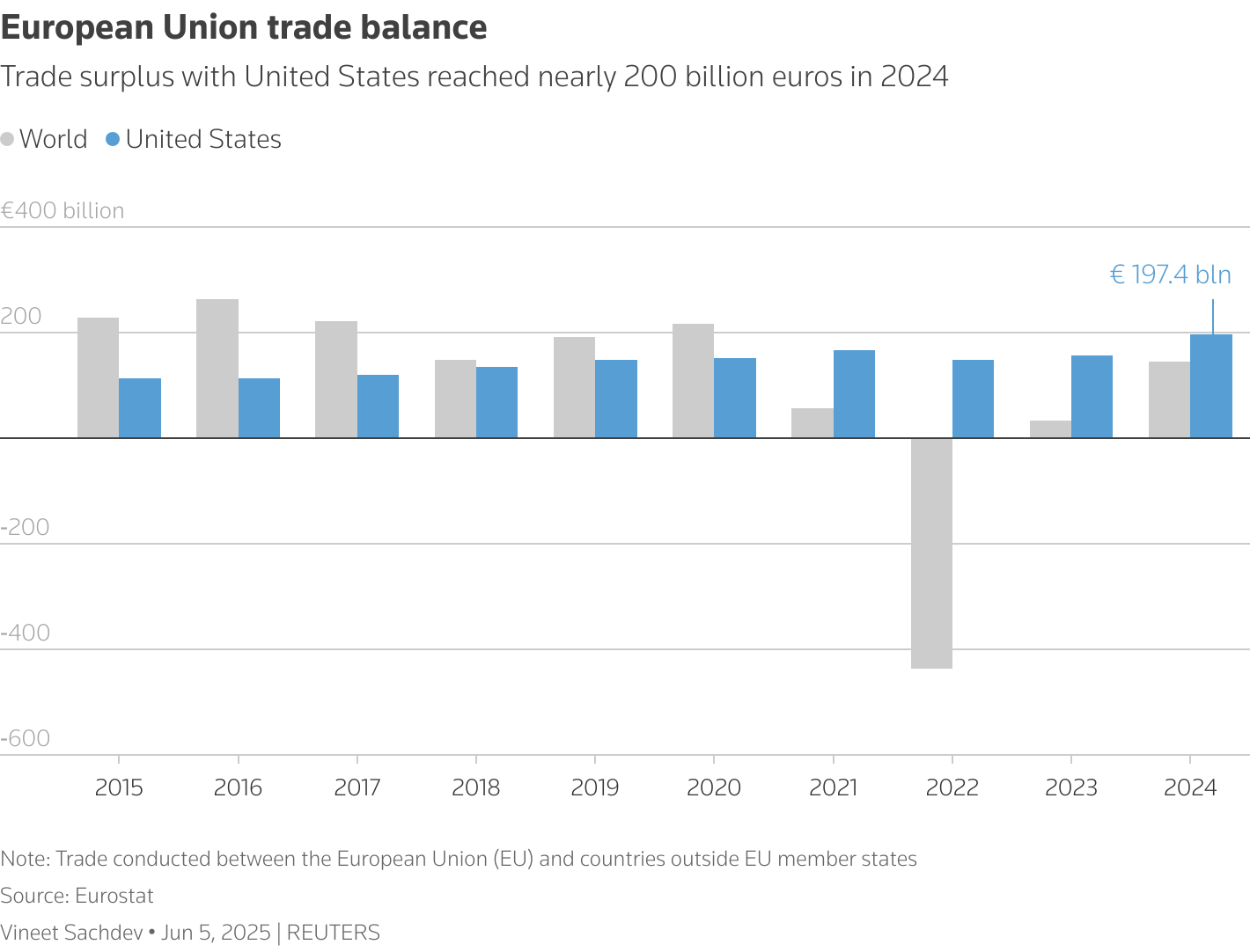

April trade data for the European Union on June 13 could offer a reasonably clean read on where things stood as Trump's on-off tariffs began to roll out.

The EU is firmly in the U.S. president's crosshairs. Trump has said more than once the sole purpose of the EU is to "take advantage" of America, on the grounds that his country boasts a $200 billion trade deficit with the bloc in goods alone, making the EU its second-biggest goods trade partner behind China.

EU sales of cars, steel, pharmaceuticals and luxury goods and apparel among other things are big business. Trump on May 23 said he would impose a 50% tariff on all EU imports, only to back down two days later by delaying the duties by a month after a "very nice call" with European Commission President Ursula von der Leyen.

5. TAX OR OFFEND

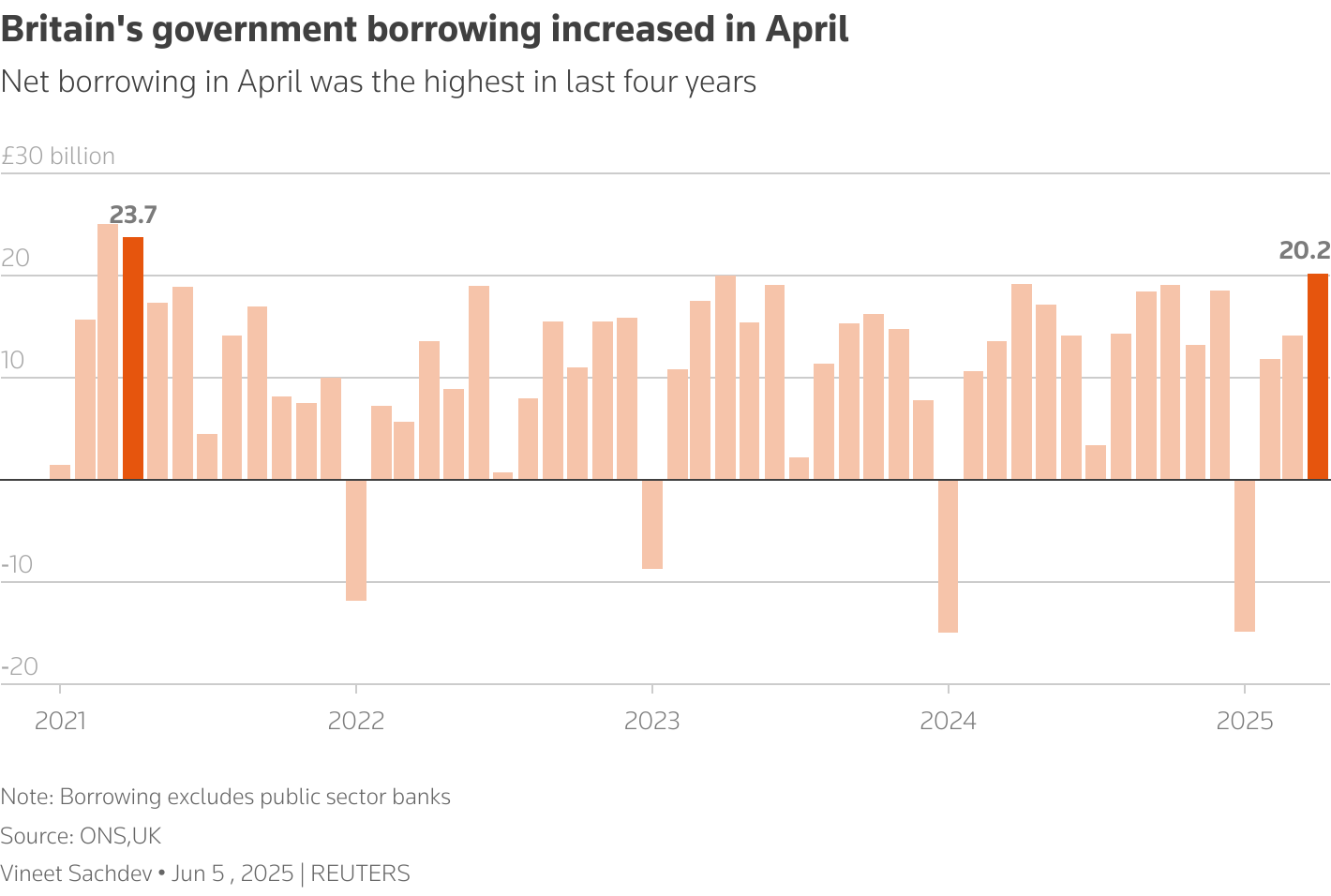

Britain, often a prime target for bond vigilantes that attack indebted governments for financial mismanagement, has been pushed into these traders' peripheral vision by U.S. budget concerns.

The Labour government's first spending review on Wednesday could bring the UK back into the spotlight. Even if finance minister Rachel Reeves manages to slash departmental spending, this will merely highlight how few cost-cutting options she has left, Bank of America says.

UK public debt has swelled, leaving Reeves minimal headroom to avoid breaking self-imposed fiscal rules and less able to resist tax hikes.

Still, businesses and borrowers still scarred by the gilt market riot after then Prime Minister Liz Truss' 2022 mini-budget may prefer higher taxes if that lowers the odds of bond vigilantes showing up.

China's May exports slow, deflation deepens as tariffs bite

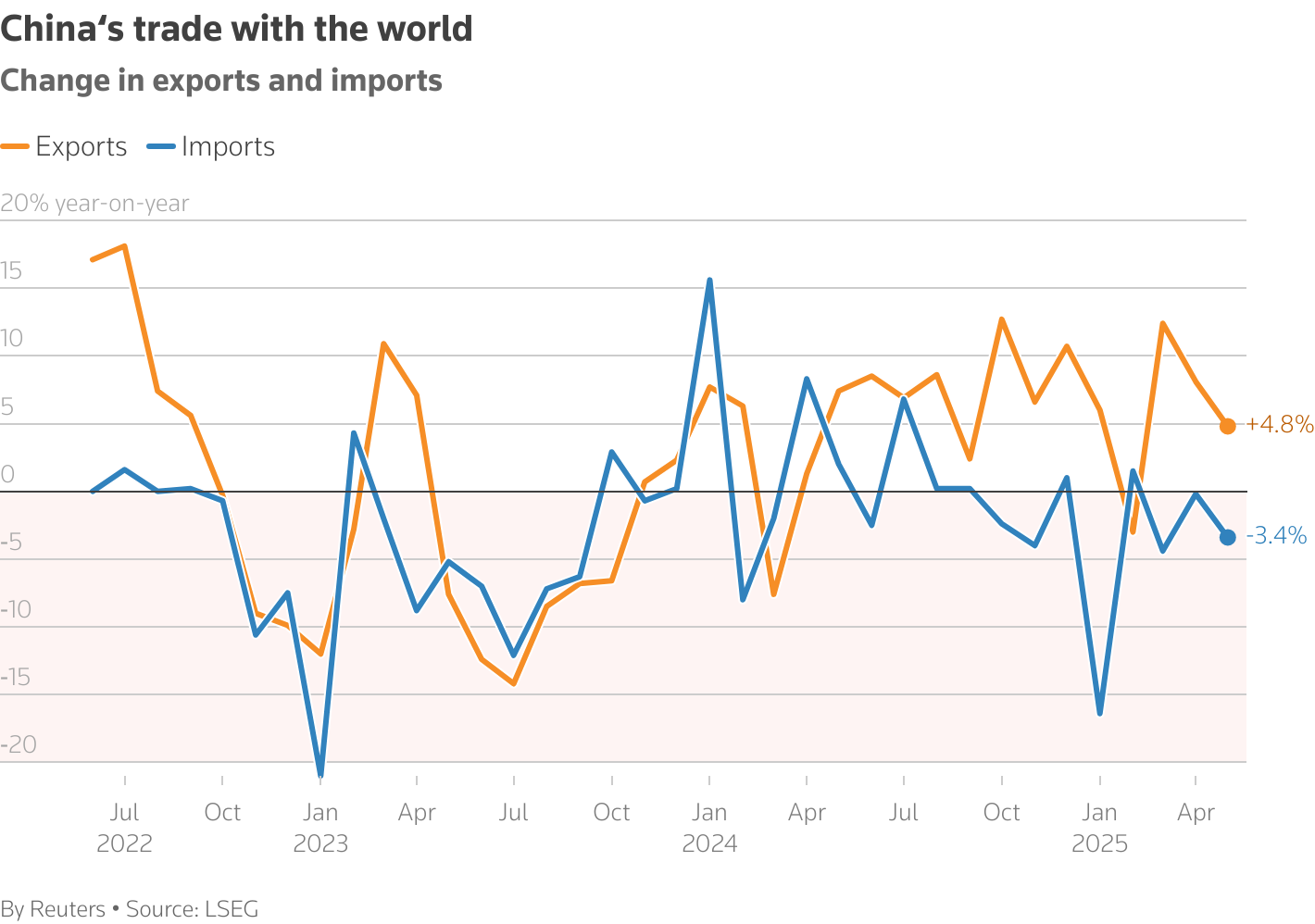

BEIJING, June 9 (Reuters) - China's export growth slowed to a three-month low in May as U.S. tariffs slammed shipments, while factory-gate deflation deepened to its worst level in two years, heaping pressure on the world's second-largest economy on both the domestic and external fronts.

U.S. President Donald Trump's global trade war and the swings in Sino-U.S. trade ties have in the past two months sent Chinese exporters, along with their business partners across the Pacific, on a roller coaster ride and hobbled world growth.

Underscoring the U.S. tariff impact on shipments, customs data showed that China's exports to the U.S. plunged 34.5% year-on-year in May in value terms, the sharpest drop since February 2020, when the outbreak of the COVID-19 pandemic upended global trade.

Total exports from the Asian economic giant expanded 4.8% year-on-year in value terms last month, slowing from the 8.1% jump in April and missing the 5.0% growth expected in a Reuters poll, customs data showed on Monday, despite a lowering of U.S. tariffs on Chinese goods which had taken effect in early April.

"It's likely that the May data continued to be weighed down by the peak tariff period," said Lynn Song, chief economist for Greater China at ING.

Song said there was still front-loading of shipments due to the tariff risks, while acceleration of sales to regions other than the United States helped to underpin China's exports.

Imports dropped 3.4% year-on-year, deepening from the 0.2% decline in April and worse than the 0.9% downturn expected in the Reuters poll.

Exports had surged 12.4% year-on-year and 8.1% in March and April, respectively, as factories rushed shipments to the U.S. and other overseas manufacturers to avoid Trump's hefty levies on China and the rest of the world.

While exporters in China found some respite in May as Beijing and Washington agreed to suspend most of their levies for 90 days, tensions between the world's two largest economies remain high and negotiations are underway over issues ranging from China's rare earths controls to Taiwan. Trade representatives from China and the U.S. are meeting in London on Monday to resume talks after a phone call between their top leaders on Thursday.

China's imports from the U.S. also lost further ground, dropping 18.1% from a 13.8% slide in April.

Zichun Huang, economist at Capital Economics, expects the slowdown in exports growth to "partially reverse this month, as it reflects the drop in U.S. orders before the trade truce," but cautions that shipments will be knocked again by year-end due to elevated tariff levels.

China's exports of rare earths jumped sharply in May despite export restrictions on certain types of rare earth products causing plant closures across the global auto supply chain.

The latest figures do not distinguish between the 17 rare earth elements and related products, some of which are not subject to restrictions. A clearer picture of the impact of the curbs on exports will only be available when more detailed data is released on June 20.

China's May trade surplus came in at $103.22 billion, up from the $96.18 billion the previous month.

Other data, also released on Monday, showed China's imports of crude oil, coal, and iron ore droppedlast month, underlining the fragility of domestic demand at a time of rising external headwinds.

Beijing in May rolled out a series of monetary stimulus measures, including cuts to benchmark lending rates and a 500 billion yuan low-cost loan program, aimed at cushioning the trade war's blow to the economy. China's markets showed muted reaction to the data. The blue-chip CSI300 Index .CSI300 climbed 0.29% and the benchmark Shanghai Composite Index .SSEC was up 0.43%.

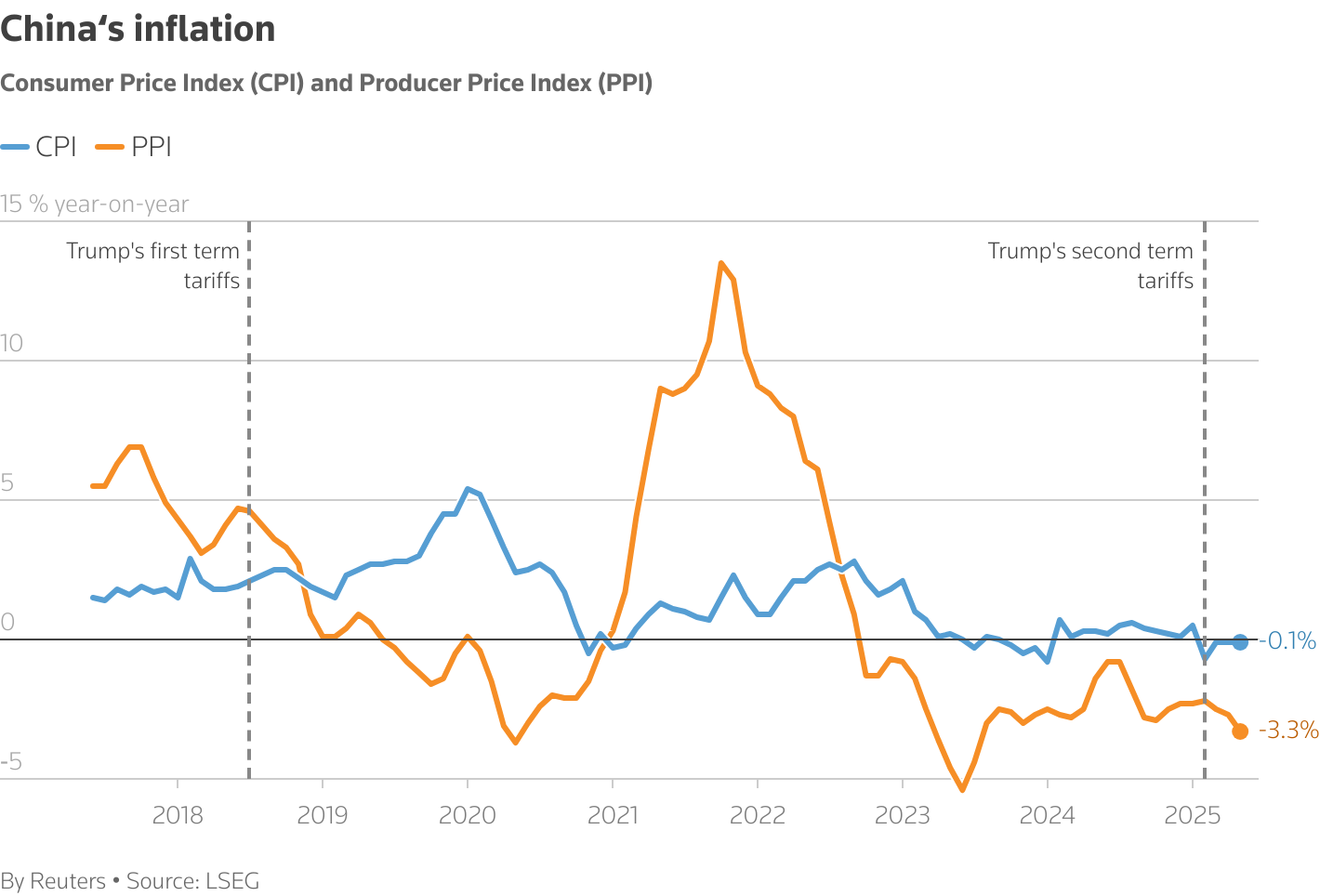

DEFLATIONARY PRESSURES

Producer and consumer price data, released by the National Bureau of Statistics on the same day, showed that deflationary pressures worsened last month. The producer price index fell 3.3% in May from a year earlier, after a 2.7% decline in April and marked the deepest contraction in 22 months.

Cooling factory activity also highlights the impact of U.S. tariffs on the world's largest manufacturing hub, dampening faster services growth as suspense lingers over the outcome of U.S.-China trade talks.

Retail sales growth slowed last month as spending continued to lag due to job insecurity and stagnant new home prices.

These headwinds were evident in China's car sales for May, which grew 13.9% year-on-year, slowing from a 14.8% increase the previous month, data from the China Passenger Car Association showed.

Sluggish domestic demand and weak prices have weighed on China's economy, which has struggled to mount a robust post-pandemic recovery amid a prolonged property slump and has relied on exports to underpin growth.

Businesses have also had to adapt to the falling prices. U.S. coffee chain Starbucks SBUX.O said on Monday it would lower prices of some iced drinks by an average of 5 yuan in China.

While the core inflation measure, excluding volatile food and fuel prices, registered a slightly faster 0.6% year-on-year rise, from a 0.5% increase in April, Capital Economics' Huang said the improvement looks "fragile".

She still expects "persistent overcapacity will keep China in deflation both this year and next."

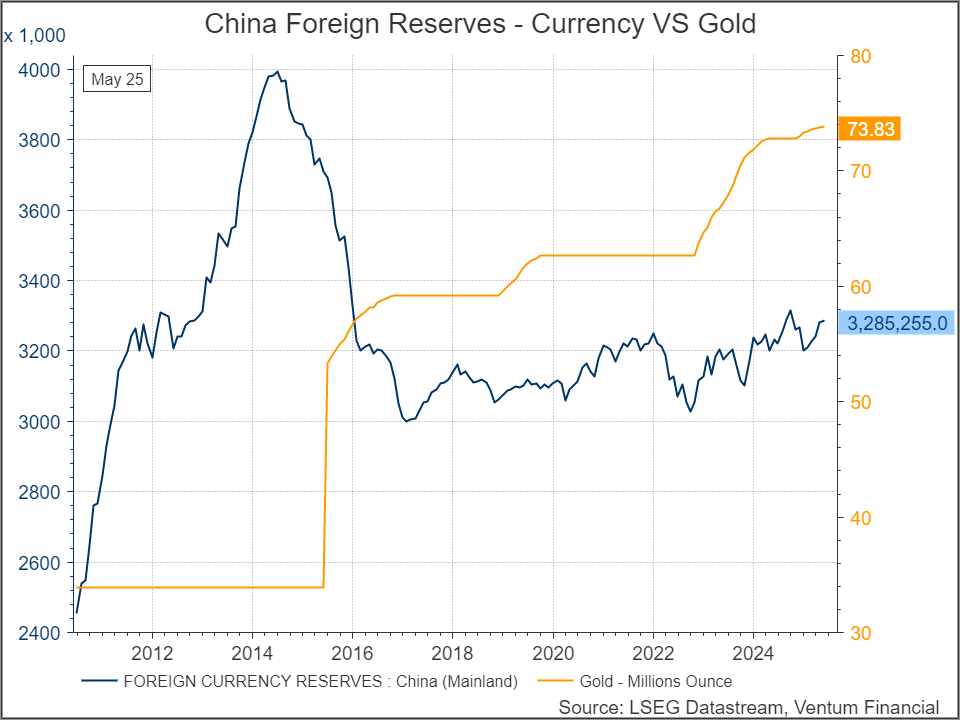

China's forex reserves up $3.6 billion in May, less than expected

BEIJING, June 7 (Reuters) - China's foreign exchange reserves rose by a less-than-expected $3.6 billion in May, official data showed on Saturday, as the dollar continued to weaken against other major currencies.

The country's foreign exchange reserves, the world's largest, rose 0.11% to $3.285 trillion last month, below the Reuters forecast of $3.292 trillion. They were $3.282 trillion in April.

The increase in reserves was due to "the combined effects of factors such as exchange rate conversion and asset price changes," China's State Administration of Foreign Exchange said in a statement.

The yuan CNY=CFXS weakened 1.05% against the dollar in May, while the dollar slid 0.23% against a basket of other major currencies =USD.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post