Weekly Economics Report - June 5, 2025

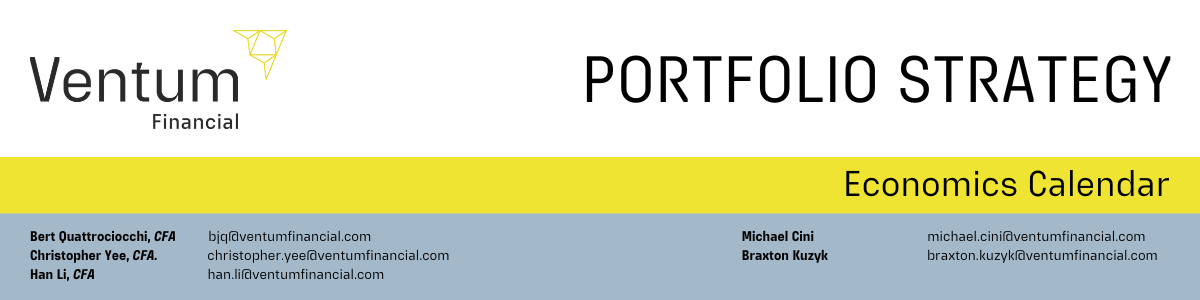

Canada factory PMI rises in May but sector remains in contraction

TORONTO, June 2 (Reuters) - Canadian manufacturing activity contracted for a fourth straight month in May as trade uncertainty led to firms shedding workers at the fastest pace since shortly after the start of the COVID-19 pandemic, data on Monday showed.

The S&P Global Canada Manufacturing Purchasing Managers' Index (PMI) edged up to 46.1 in May from 45.3 in April but was stuck below the 50 no-change level for the fourth straight month. A reading below 50 indicates contraction in the sector. “With manufacturers continuing to be hit by tariffs and trade uncertainty, May saw the sector experience a further significant contraction," Paul Smith, economics director at S&P Global Market Intelligence, said in a statement. "The hard to predict nature of trade policies means the outlook for production remains extremely uncertain and given the recent scale of the downturn in the sector, job losses are mounting."

The employment component fell to 44.9 from 47.6 in April, marking the lowest level since June 2020, while measures of output and new orders also remained in contraction. Canada sends about 75% of its exports to the United States, including steel, aluminum and autos which have been hit with hefty U.S. duties. Retaliatory tariffs have been imposed on some U.S. goods.

“Unsurprisingly, tariffs remain the primary source of price pressures, whilst also leading to an intensification of supply side delays," Smith said.

The measure of input prices rose to 63.5 from 62.1 in April, leaving it just below the 31-month peak it touched in March, while the average lead times for the delivery of inputs lengthened for an 11th straight month. The deterioration in vendor performance was linked to port congestion and challenges at customs.

The Future Output Index edged up to 50.9 from 50.4 in April, with some firms hopeful that government policies could help stabilize the macroeconomic environment, but was well below the survey's historical norm, S&P Global said. Canadian Prime Minister Mark Carney, whose Liberal Party retained power in an April election, has proposed sweeping changes to boost economic growth.

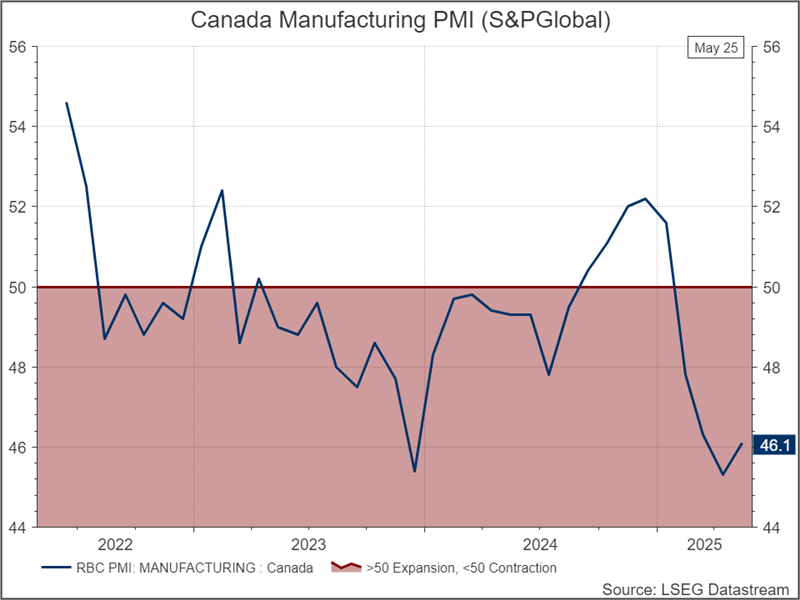

US manufacturing remains subdued in May; delivery times lengthening

WASHINGTON, June 2 (Reuters) - U.S. manufacturing contracted for a third straight month in May and suppliers took longer to deliver inputs amid tariffs, potentially signaling looming shortages of some goods.

The Institute for Supply Management (ISM) said on Monday that its manufacturing PMI edged down to a six-month low of 48.5 last month from 48.7 in April. A PMI reading below 50 indicates contraction in the manufacturing sector, which accounts for 10.2% of the economy.

The PMI, however, remains above the 42.3 level that the ISM says over time indicates an expansion of the overall economy. Economists polled by Reuters had forecast the PMI rising to 49.3. The survey suggested manufacturing, which is heavily reliant on imported raw materials, had not benefited from the de-escalation in trade tensions between President Donald Trump's administration and China.

Economists say the on-gain, off-again manner in which the import duties are being implemented is making it difficult for businesses to plan ahead. Another layer of uncertainty was added by a U.S. trade court last week blocking most of Trump's tariffs from going into effect, ruling that the president overstepped his authority. But the tariffs were temporarily reinstated by a federal appeals court on Thursday.

The ISM survey's supplier deliveries index increased to 56.1 from 55.2 in April. A reading above 50 indicates slower deliveries. A lengthening in suppliers' delivery times is normally associated with a strong economy. But in this case slower supplier deliveries likely indicated bottlenecks in supply chains related to tariffs.

In April, the ISM noted delays in clearing goods through ports. Port operators have reported a decline in cargo volumes.

The ISM's imports measure dropped to 39.9 from 47.1 in April. Production at factories remained subdued, while new orders barely saw an improvement.

The ISM survey's forward-looking new orders sub-index inched up to 47.6 from 47.2 in April. Its measure of prices paid by manufacturers for inputs eased to a still-high 69.4 from 69.8 in April, reflecting strained supply chains.

Factories continued to shed jobs. The survey's measure of manufacturing employment nudged up to 46.8 from 46.5 in April. The ISM previously noted that companies were opting for layoffs rather than attrition to reduce headcount.

US Construction Spending Shrinks Again in April

Construction spending in the United States fell by 0.4% month-over-month to a seasonally adjusted annual rate of $2,152.4 billion in April 2025, after a revised 0.8% decrease in March and missing market forecasts of a 0.3% rise. Private sector spending declined by 0.7% in the period, led by a 0.9% drop in non-residential investment and a 0.5% fall in the residential segment. Meanwhile, public spending edged up 0.4%. On a yearly basis, construction spending shrank by 0.5% in April.

Source: Tradingeconomics.com

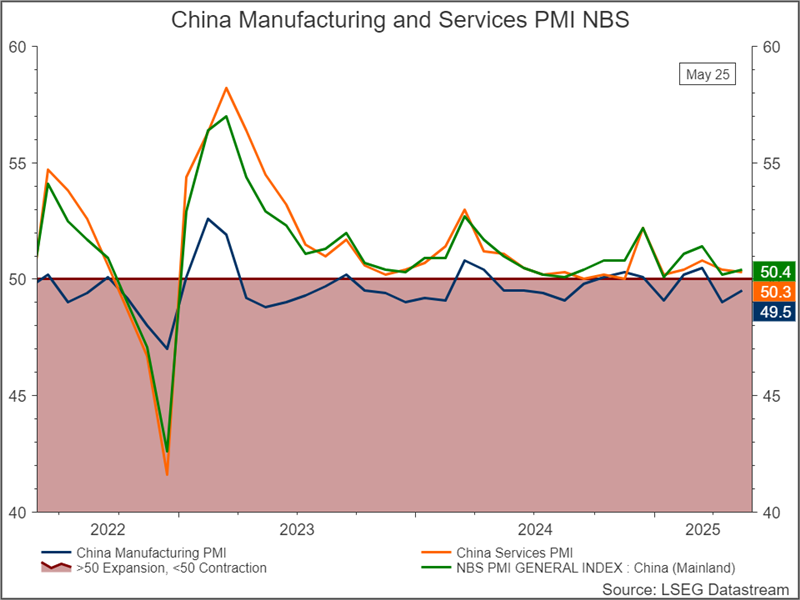

China’s manufacturing activity contracts amid trade tension

BEIJING, May 31 (Reuters) - China's manufacturing activity contracted in May for a second month, an official survey showed on Saturday, fuelling expectations for more stimulus to support the economy amid a protracted trade war with the United States.

The official purchasing managers' index (PMI) improved slightly to 49.5 in May from 49.0 in April but stayed below the 50-mark separating growth from contraction, in line with a median forecast of 49.5 in aReuters poll.

On Friday, U.S. President Donald Trump accused China of violating a two-way deal to roll back tariffs and unveiled a doubling of worldwide steel and aluminium tariffs to 50%, once again rattling international trade.

"Recent developments between China and the United States suggest bilateral relations are not improving," said Zhiwei Zhang, chief economist at Pinpoint Asset Management. "Firms in China and the United States with exposure to international trade have to run their business under persistently high uncertainty. It will weigh on the growth outlook in both countries. "The new orders sub-index rose to 49.8 in May from 49.2 in April, while the new export orders sub-index rose to 47.5 from 44.7.

Some firms reported a noticeable rebound in trade with the United States, with improvements in both imports and exports, said senior NBS statistician Zhao Qinghe. The non-manufacturing PMI, which includes services and construction, fell to 50.3 from 50.4, staying above the 50-mark separating growth from contraction. Analysts expect Beijing to deliver more monetary and fiscal stimulus over the coming months to underpin growth and insulate the economy from the tariffs.

Interest rate cuts and a major liquidity injection were among easing steps unveiled by the central bank this month.

Beijing and Washington have agreed to a 90-day pause during which both would cut import tariffs, raising hopes of easing tension, but investors worry negotiations will be slow amid persistent global economic risks.

Trump's decision to single out China in his global trade war has stirred major worries about an economy that has been reliant on an export-led recovery to drive momentum in the face of weak domestic demand and deflationary pressures.

On Monday, rating agency Moody's maintained its negative outlook on China, citing unease over tensions with major trade partners could have a lasting impact on its credit profile.

But it acknowledged that government policy had tackled its previous concerns about the health of state-owned firms and local government debt that prompted a downgrade in late 2023.

China's economy expanded faster than expected in the first quarter, and the government has maintained a growth target of about 5% this year, but analysts fear U.S. tariffs could drive momentum sharply lower. Exports beat forecasts in April, buoyed by demand for materials from overseas manufacturers who rushed out goods to make the most of President Trump's 90-day tariff pause.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post