Weekly Economics Report - April 28, 2025

Carney pledges tax cuts, defense spending in Canada election platform

TORONTO, April 19 (Reuters) - Canadian Prime Minister Mark Carney's campaign platform plans released on Saturday include tax cuts and new spending on infrastructure and defense, as he pledges a new economic order that is less reliant on the United States.

Carney has campaigned on his experience managing crises while running the central bank of Canada during the 2008 financial crisis and that of Britain during Brexit. He often says he is the best person to stand up to U.S. President Donald Trump, who has imposed tariffs on Canada and threatened to annex the country.

"We're in an enormous crisis, so we have to be able to do two things. One, hold down on that wasteful spending, which we will do, but much more than that, we need to be bold and drive investment in the economy and take the amazing opportunities we have," Carney said at a press conference.

Carney has also aimed to distance himself from predecessor Justin Trudeau by promising a leaner government.

Carney's plan would push the federal government's deficit to 1.96% of Gross Domestic Product (GDP) in the 2025-26 fiscal year, down to 1.83% of GDP the following year, and to 1.35% by 2028-29, the platform says. Trudeau's government had last forecast a deficit of 1.6% of GDP for the previous fiscal year that ended in March.

Carney plans to break up spending into operating and capital spending, which would be new in Canada. Carney told the press conference government spending had been growing by around 9% every year and his government would bring that rate of spending growth to around 2% without cutting any transfers to provinces, territories or individuals. He promised to balance the operating budget over the next three years. "Our plan gets government spending under control because the government has been spending too much and Canada has been investing too little," Carney said. Carney plans to increase defense spending to exceed a NATO target of 2% of GDP and said Canada would invest in transatlantic security with "like minded" European partners.

China keeps lending rates steady; trade war raises bets for stimulus

WHY IT’S IMPORTANT

SHANGHAI, April 21 (Reuters) - China kept benchmark lending rates steady on Monday for the sixth successive month, matching market expectations.

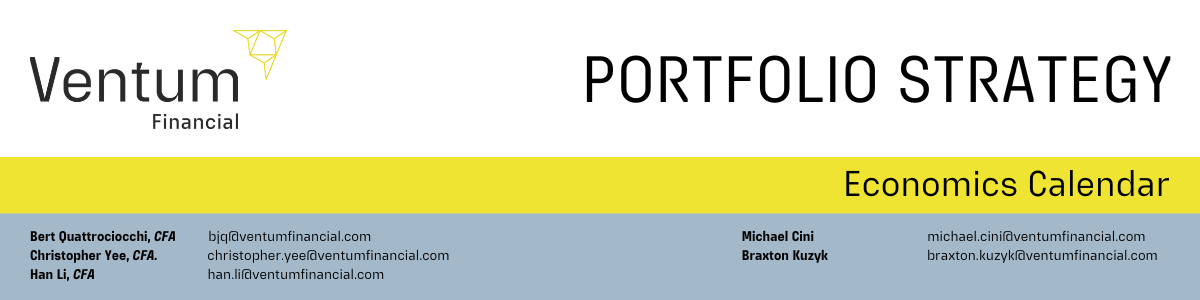

Stronger-than-expected first-quarter economic growth data might have reduced the urgency for immediate monetary easing even as markets wager more stimulus is likely in coming months to keep growth on an even keel amid an intensifying Sino-U.S. trade war. Policymakers are also wary of a weakening Chinese yuan and shrinking interest margins at lenders, limiting the scope for easing.

BY THE NUMBERS

The one-year loan prime rate (LPR) CNYLPR1Y=CFXS was kept at 3.1%, while the five-year LPR CNYLPR5Y=CFXS was unchanged at 3.6%.

In a Reuters poll of 31 market participants conducted last week, 27, or 87%, expected no change to either of the rates.

CONTEXT

China's gross domestic product (GDP) grew 5.4% in the first quarter, beating expectations, but markets fear a sharp downturn in the year ahead as U.S. tariff policies pose the biggest risk to the Asian powerhouse in decades.

Export data was yet to capture the impact of higher U.S. tariffs as many factories front-loaded their orders to beat the duties, analysts said.

A string of global investment banks have lowered their projections for China's economic growth this year and expected more monetary easing measures to underpin the economy.

KEY QUOTES

** Xing Zhaopeng, senior China strategist at ANZ, said the steady LPR fixings suggested that policymakers remain in a wait-and-see mode.

"The impact of tariffs is mainly on exports. Given the sound economic growth in the first quarter, it may be easier to introduce targeted measures for export companies," Xing said.

** "The LPR is not seen moving without a cut to the seven-day reverse repo rate first," economists at ING said in a note. "Low inflation and strong external headwinds amid escalating tariff threats provide a strong case for easing. But currency stabilisation considerations may prompt the People's Bank of China to wait until the U.S. Federal Reserve cuts borrowing costs."

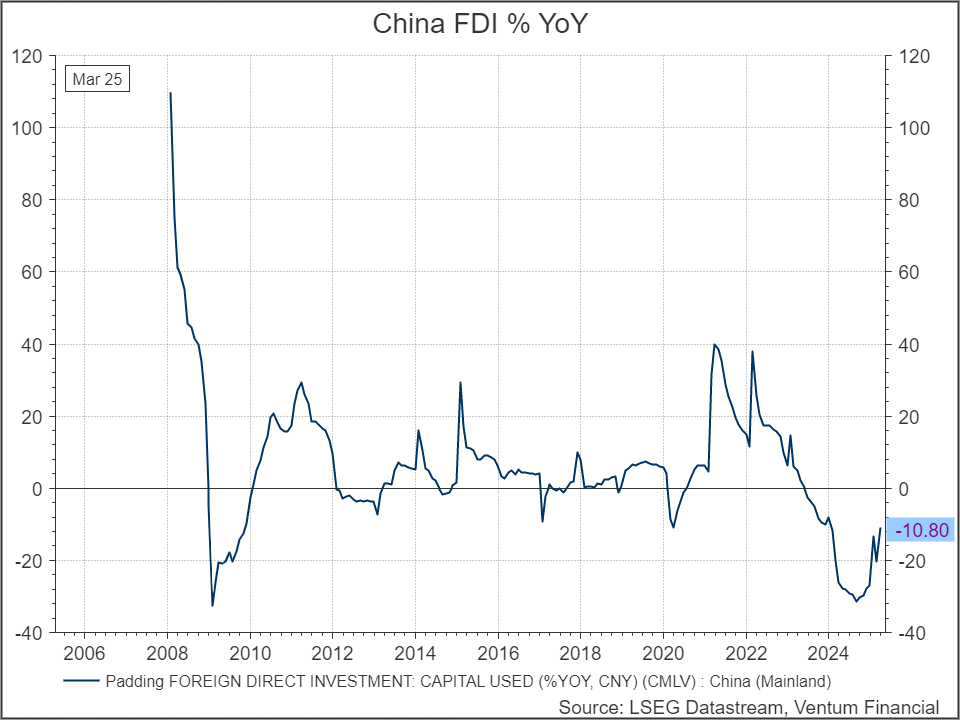

Foreign direct investment in China falls 10.8% in January-March

BEIJING, April 18 (Reuters) - Foreign direct investment in China totalled 269.2 billion yuan ($36.86 billion) from January to March, down 10.8% from the same period last year, the commerce ministry said on Friday.

Consumer sentiment fell for the fourth straight month, and has now lost more than 30% since December 2024 amid growing worries about trade war developments that have oscillated over the course of the year. Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month.

Source: Tradingeconomics.com

China warns countries against striking trade deals with US at its expense

BEIJING, April 21 (Reuters) - China on Monday accused Washington of abusing tariffs and warned countries against striking a broader economic deal with the United States at its expense, ratcheting up its rhetoric in a spiralling trade war between the world's two biggest economies. Beijing will firmly oppose any party striking a deal at China's expense and "will take countermeasures in a resolute and reciprocal manner," its Commerce Ministry said.

The ministry was responding to a Bloomberg report, citing sources familiar with the matter, that the Trump administration is preparing to pressure nations seeking tariff reductions or exemptions from the U.S. to curb trade with China, including imposing monetary sanctions. President Donald Trump paused the sweeping tariffs he announced on dozens of countries on April 2 except those on China, singling out the world's second largest economy for the biggest levies.

In a series of moves, Washington has raised tariffs on Chinese imports to 145%, prompting Beijing to slap retaliatory duties of 125% on U.S. goods, effectively erecting trade embargoes against each other. Last week, China signalled that its own across-the-board rates would not rise further.

"The United States has abused tariffs on all trading partners under the banner of so-called 'equivalence', while also forcing all parties to start so-called 'reciprocal tariffs' negotiations with them," the ministry spokesperson said.

China is determined and capable of safeguarding its own rights and interests, and is willing to strengthen solidarity with all parties, the ministry said.

"The fact is, nobody wants to pick a side," said Bo Zhengyuan, partner at China-based policy consultancy Plenum. "If countries have high reliance on China in terms of investment, industrial infrastructure, technology know-how and consumption, I don't think they'll be buying into U.S. demands. Many Southeast Asian countries belong to this category."

Pursuing a hardline stance, Beijing will this week convene an informal United Nations Security Council meeting to accuse Washington of bullying and "casting a shadow over the global efforts for peace and development" by weaponizing tariffs. Earlier this month, U.S. Trade Representative Jamieson Greer said nearly 50 countries have approached him to discuss the steep additional tariffs imposed by Trump.

Several bilateral talks on tariffs have taken place since, with Japan considering raising soybean and rice imports as part of its talks with the U.S. while Indonesia is planning to increase U.S. food and commodities imports and reduce orders from other nations.

CAUGHT IN CROSSFIRE

Trump's tariff policies have rattled financial markets as investors fear a severe disruption in world trade could tip the global economy into recession.

On Monday, Chinese stocks inched higher, showing little reaction to the commerce ministry comments, though investors have generally remained cautious on Chinese assets due to the rising growth risks.

The Trump administration also has been trying to curb Beijing's progress in developing advanced semiconductor chips which it says could be used for military purposes, and last week imposed port feeson China-built vessels to limit China's dominance in shipbuilding.

AI chip giant Nvidia said last week it would take $5.5 billion in charges due to the administration's curbs on AI chip exports. China's President Xi Jinping visited three Southeast Asian countries last week in a move to bolster regional ties, calling on trade partners to oppose unilateral bullying.

Beijing has said it is "tearing down walls" and expanding its circle of trading partners amid the trade row.

The stakes are high for Southeast Asian nations caught in the crossfire of the Sino-U.S. tariff war, particularly given the regional ASEAN bloc's huge two-way trade with both China and the United States. Economic ministers from Thailand and Indonesia are currently in the United States, with Malaysia set to join later this week, all seeking trade negotiations.

Six countries in Southeast Asia were hit with tariffs ranging from 32% to 49%, threatening trade-reliant economies that have benefited from investment from levies imposed on Beijing by Trump in his first term. ASEAN is China's largest trading partner, with total trade value reaching $234 billion in the first quarter of 2025, China's customs agency said last week. Trade between ASEAN and the U.S. totalled around $476.8 billion in 2024, according to U.S. figures, making Washington the regional bloc's fourth-largest trading partner. "There are no winners in trade wars and tariff wars," Xi said in an article published in Vietnamese media, without mentioning the United States.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post