Weekly Economics Report - May 18, 2025

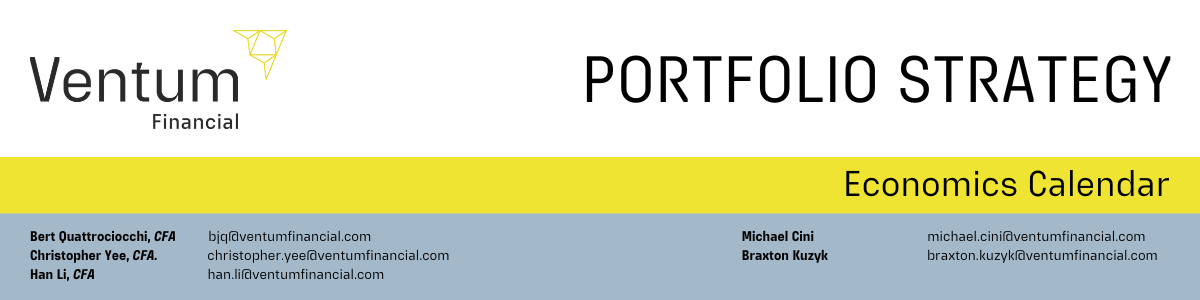

US import prices unexpectedly rise in April

WASHINGTON, May 16 (Reuters) - U.S. import prices unexpectedly rose in April as a surge in the cost of capital goods offset cheaper energy products.

Import prices gained 0.1% last month after dropping 0.4% in March, the Labor Department's Bureau of Labor Statistics said on Friday. Economists polled by Reuters had forecast import prices, which exclude tariffs, would decrease 0.4%. In the 12 months through April, import prices edged up 0.1%.

Data this week showed benign consumer and producer price readings in April. Economists expect the impact of President Donald Trump's sweeping import duties to become evident in inflation data by the middle of this year. The tariffs have raised fears of a slowdown in global growth, contributing to a dampening of oil prices.

Federal Reserve Chair Jerome Powell warned on Thursday that "we may be entering a period of more frequent, and potentially more persistent, supply shocks - a difficult challenge for the economy and for central banks."

Economists expect the U.S. central bank will resume cutting interest rates either in September or December. The Fed left its benchmark overnight interest rate in the 4.24%-4.50% range earlier this month.

Imported fuel prices fell 2.6% in April after decreasing by 3.4% in March. Food prices were unchanged after dipping 0.1% in the prior month. Excluding fuels and food, import prices shot up 0.5%. That followed a 0.1% dip in March. In the 12 months through March, the so-called core import prices increased 0.8%. Prices for imported capital goods jumped 0.6%, while those of consumer goods excluding motor vehicles increased 0.3%. Prices for imported motor vehicles, parts and engines rose 0.2%.

The weakness of the dollar is likely contributing to the firmness in these import prices.

Trump's aggressive trade policies have rattled investors' confidence in the dollar, leading to a sharp fall in U.S. assets. The trade-weighted dollar is down about 5.1% this year, with most of the depreciation occurring in April.

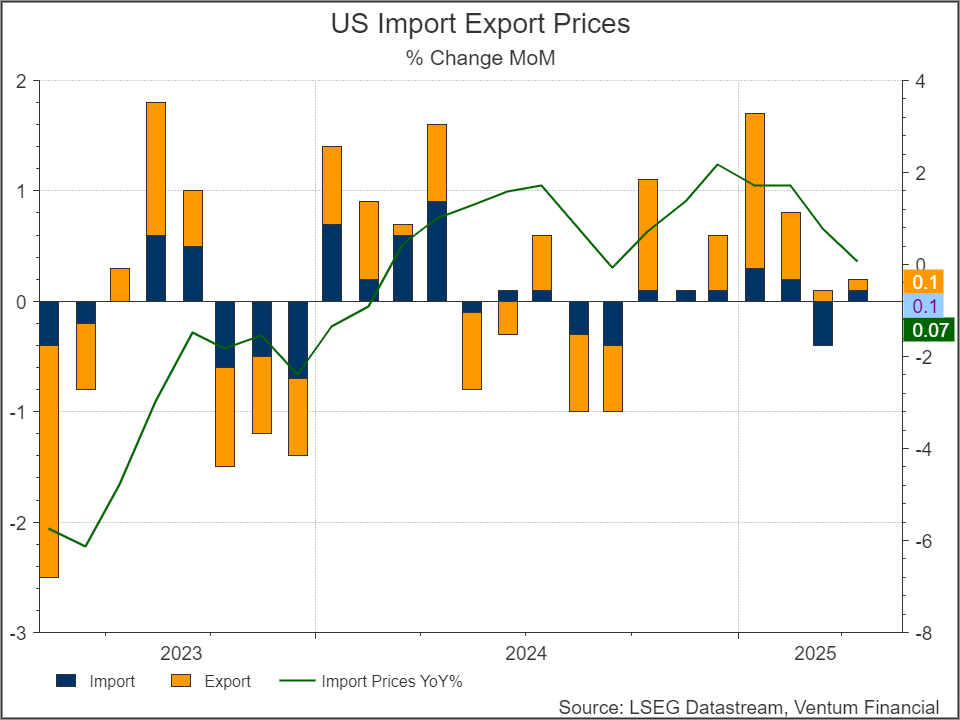

US single-family housing starts, building permits fell in April

WASHINGTON, May 16 (Reuters) - U.S. single-family homebuilding fell in April as tariffs on imported materials and high mortgage rates remained major obstacles for the housing market.

Single-family housing starts, which account for the bulk of homebuilding, dropped 2.1% to a seasonally adjusted annual rate of 927,000 units last month, the Commerce Department's Census Bureau said on Friday.

President Donald Trump's aggressive and erratic tariffs, including duties on lumber and steel, have left builders reeling. The United States and China de-escalated their trade war over the weekend, but uncertainty remains over what happens after the 90-day truce they agreed on. There is also no clarity on the fate of country-specific duties which were delayed until July.

A National Association of Home Builders survey on Thursday showed sentiment among single-family homebuilders plunged to a 1-1/2-year low in May, with 78% of builders reporting "difficulties pricing their homes recently due to uncertainty around material prices." There is also a glut of unsold new homes, with inventory at levels last seen in late 2007.

Permits for future construction of single-family housing declined 5.1% to a rate of 922,000 units in March. Residential investment, which includes homebuilding, rebounded in 2024 after steep declines in the prior two years caused by a surge in mortgage rates. It grew at a moderate pace in the first quarter of 2025.

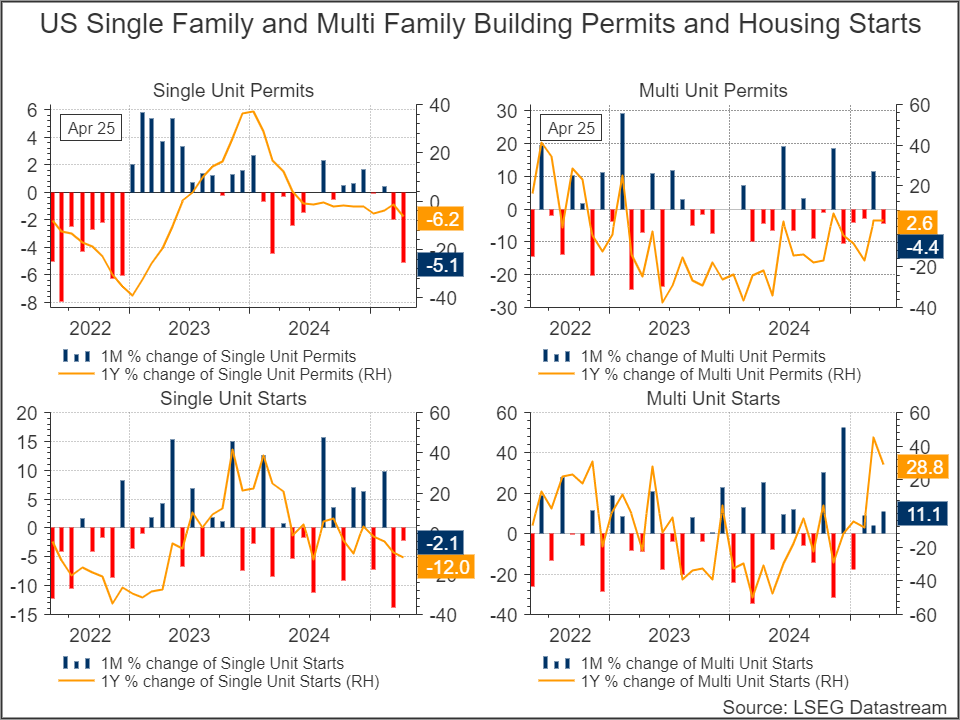

University of Michigan Survey of Consumers

Consumer sentiment was essentially unchanged this month, inching down a scant 1.4 index points following four consecutive months of steep declines. Sentiment is now down almost 30% since January 2025. Slight increases in sentiment this month for independents were offset by a 7% decline among Republicans. While most index components were little changed, current assessments of personal finances sank nearly 10% on the basis of weakening incomes.

Tariffs were spontaneously mentioned by nearly three-quarters of consumers, up from almost 60% in April; uncertainty over trade policy continues to dominate consumers’ thinking about the economy. Note that interviews for this release were conducted between April 22 and May 13, closing two days after the announcement of a pause on some tariffs on imports from China. Many survey measures showed some signs of improvement following the temporary reduction of China tariffs, but these initial upticks were too small to alter the overall picture – consumers continue to express somber views about the economy. The initial reaction so far echoes the very minor increase in sentiment seen after the April 9 partial pause on tariffs, despite which sentiment continued its downward trend.

Year-ahead inflation expectations surged from 6.5% last month to 7.3% this month. This month’s rise was seen among Democrats and Republicans alike. Long-run inflation expectations lifted from 4.4% in April to 4.6% in May, reflecting a particularly large monthly jump among Republicans. The final release for May will reveal the extent to which the May 12 pause on some China tariffs leads consumers to update their expectations.

Source: University of Michigan

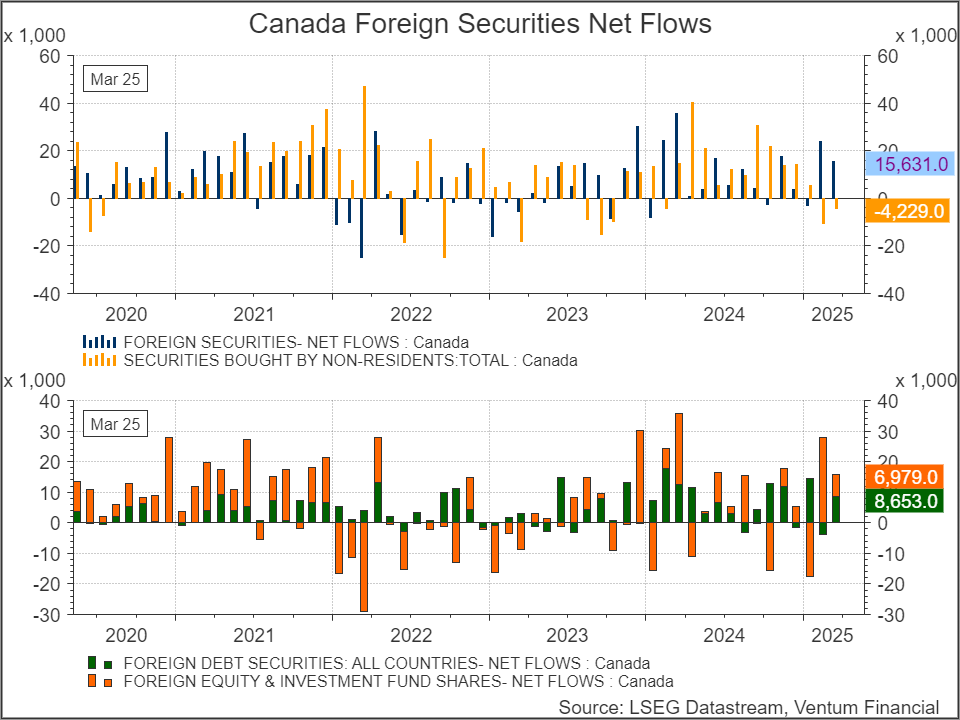

Foreigners sell C$4.23 bln in Canadian securities in March

May 16 (Reuters) - Foreign investors sold a net C$4.23 billion ($3.03 billion) in Canadian securities in March, led by federal equity securities, following an downwardly revised C$10.45 billion total sale in February, Statistics Canada said on Friday. Canadian investors bought a net C$15.63 billion worth of foreign securities, led by purchases of U.S. government bonds.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post