Weekly Economics Report - May 12, 2025

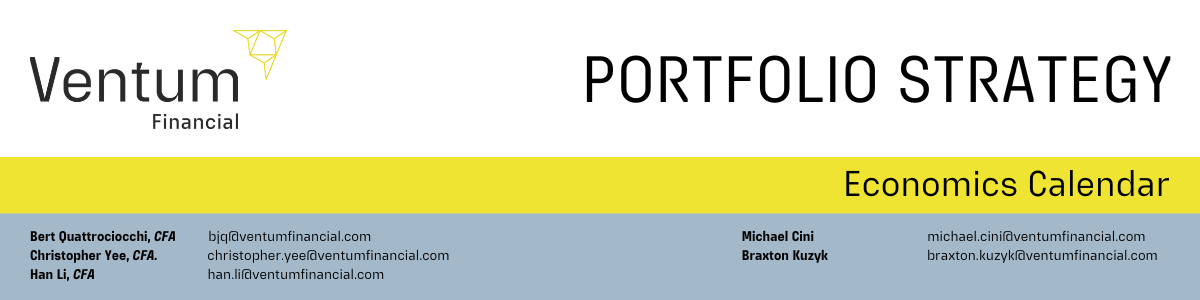

Canada’s unemployment rate jumps to 6.9% in April as Trump tariffs bite

OTTAWA, May 9 (Reuters) - Canada's unemployment rate rose to 6.9% in April, the highest since November, as

U.S. tariffs started to hit Canada's export-dependent economy in earnest, data showed on Friday.

The high unemployment rate in Canada, where the number of jobless people is inching towards 1.6 million, was partly a result of U.S. President Donald Trump's tariffs on a raft of Canadian imports, Statistics Canada said, referring to the jobs shed in the manufacturing sector.

Overall, the employment number was largely flat with minimal gains of net 7,400 jobs in April, it said. This was in contrast to a loss of 32,600 jobs the prior month.

Analysts polled by Reuters had predicted employment to increase by 2,500 people and the unemployment rate to increase to 6.8%. The 6.9% figure matched November unemployment, which was an eight-year high outside of the pandemic era.

Trump's tariffs on Canadian steel and aluminum in March and automobiles in April, along with import duties on a broad range of products with various reductions and exemptions have impacted businesses and households.

The Bank of Canada has warned that growth would take a major hit in coming months as exports fall, prices increase, hiring reduces and layoffs accelerate. It has vowed to act decisively if the economy needs urgent support. "Overall, we are seeing a job market that was weak heading into the trade war, now looking like it could soon buckle. Today's report supports the case for a Bank of Canada cut in June," said Ali Jaffery, senior economist at CIBC Capital Markets.

BETS ON JUNE RATE CUT

Currency swap market bets show odds of a 25 basis point rate cut in June at over 55% roughly. 0#CADIRPR

The Canadian dollar CAD= was trading up 0.1% to 1.3909 U.S. dollar, or 71.90 U.S. cents. Yields on two-year government bonds CA2YT=RR fell 3.3 basis points to 2.586% after the labor force data was released.

The number of unemployed people, or those looking for work or on temporary layoff, increased by 39,000 or 2.6% in April, and was up by 189,000 or 13.9% on a year-over-year basis. "People who were unemployed continued to face more difficulties finding work in April than a year earlier," Statscan said, adding that among those who were unemployed in March, 61% remained unemployed in April which was almost four percentage points higher than the same period last year.

The tariffs and the uncertainty around them especially hit the manufacturing sector which shed 31,000 jobs in the month, Statscan said, adding retail and wholesale trade also saw a drop in the number of employed people.

The employment rate, or the proportion of the working age population that is employed, was at 60.8% in April, following a decline of 0.2 percentage points in March. This was a six-month low, the statistics agency said.

The employment rate had been depressed for most of 2023 and 2024 as population growth outpaced employment gains. However, since February population growth has not been very high but employment gains have slowed.

Employment in the public sector increased by 23,000 or up 0.5% in April, following three consecutive months of little change, especially due to increased temporary hiring for the federal election. The average hourly wage growth of permanent employees, a metric closely watched by the Canadian central bank to gauge inflationary trends, was at 3.5% in April, same as March.

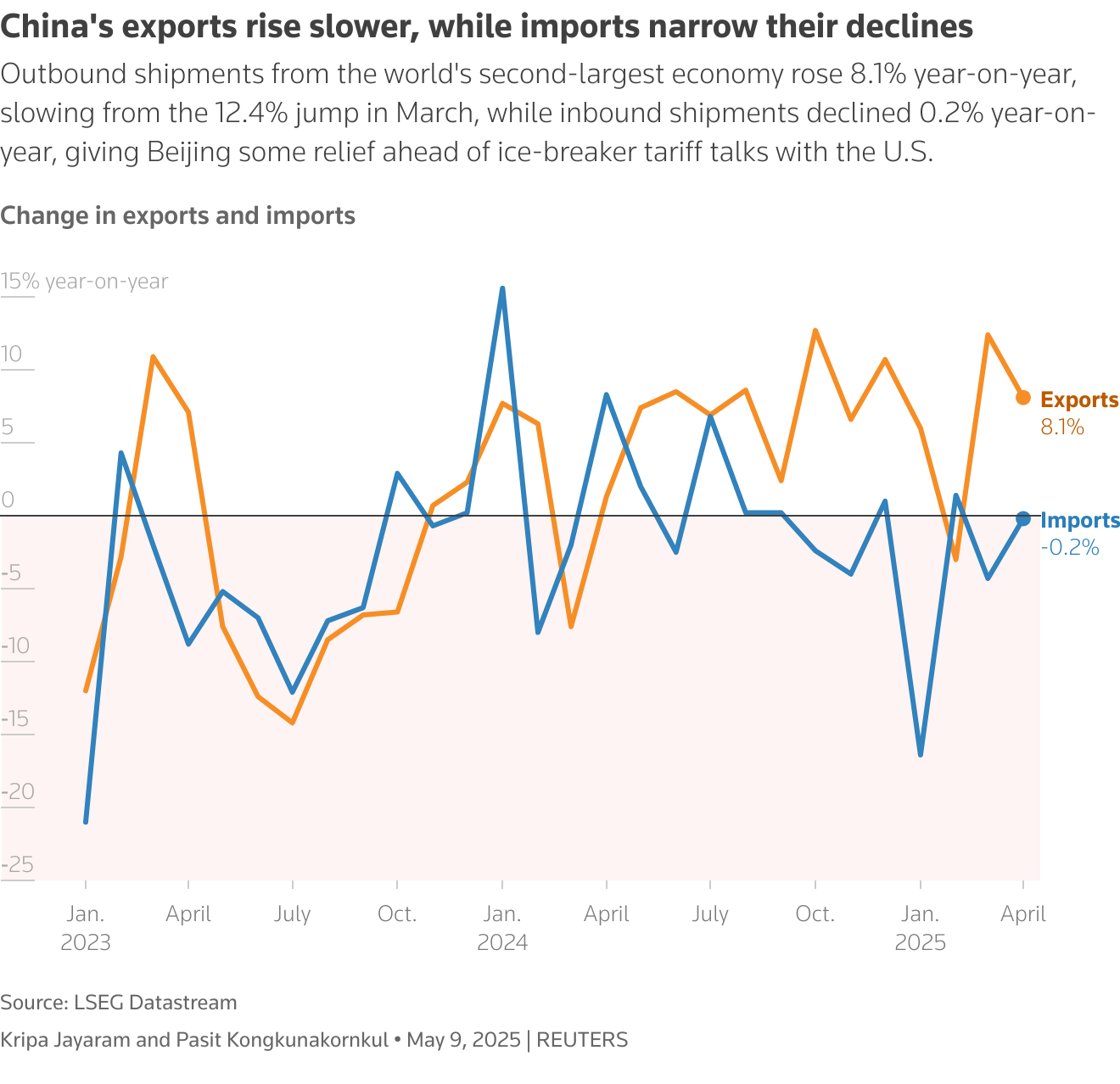

China’s exports top forecasts helped by global rush to beat tariffs

BEIJING, May 9 (Reuters) - China's exports beat forecasts in April, buoyed by demand for materials from overseas manufacturers who rushed out goods to make the most of U.S. President Donald Trump's 90-day tariff pause.

The world's two largest economies have been locked in a bruising tit-for-tat tariff war and businesses on both sides of the Pacific will be looking for some kind of resolution at closely watched trade talks in Switzerland this weekend. Customs data on Friday showed outbound shipments from China rose 8.1% year-on-year in April, beating a forecast 1.9% increase in a Reuters poll of economists but slowing from the 12.4% jump in March.

Trump announced sweeping "reciprocal tariffs" of 10% on April 2, before offering a pause for most countries while the White House worked on multiple trade deals. China, however, was excluded from the reprieve and singled out for levies of 145%, kicking off a protracted cat-and-mouse game that has rattled global markets and upended supply chains.

Chinese manufacturers had also been front-loading outbound shipments in anticipation of the duties, but are now banking on ice-breaker tariff talks between American and Chinese officials in Geneva on Saturday. Imports fell 0.2%, compared with expectations for a 5.9% drop, suggesting domestic demand may be holding up better than expected as policymakers continue to take steps to prop up the $19 trillion economy.

"The ASEAN countries are speeding up their production to meet the July deadline, the 90-day negotiation break. Their production is highly reliant on China's exports in raw materials and industrial inputs, so China's exports got support," said Dan Wang, China director at Eurasia Group.

"Over the next two months, China's exports could continue to be strong due to industrial capacity relocation, but the trade data could deteriorate quite quickly if the 145% tariffs on China are still in place and ASEAN countries' talks (with the Trump administration) don't make progress," she added.

Exports to Southeast Asian countries rose 20.8% in April.

China's exports to the U.S., meanwhile, fell 21%. That meant the trade surplus with the U.S. dropped to $20.5 billion from $27.6 billion in March, a win for Trump, who has repeatedly said he wants to narrow the gap.

HIGH STAKES

Beijing cannot afford a trade war with the U.S. but sees Trump's tariffs as unwelcome interference, with officials wanting to implement the painful domestic reforms needed to shore up long-term growth at their own pace. If not lowered or removed, the tariffs could deal a heavy blow to China's economy, which has relied on exports to drive growth as it struggles to recover from the pandemic shocks and a protracted property market slump.

"The damage of the U.S. tariffs has not shown up in the trade data for April," said Zhiwei Zhang, chief economist at Pinpoint Asset Management. "I expect the trade data will weaken in the next few months gradually." "Hopefully, the trade negotiations between China and the U.S. can reach agreement soon and bring down tariffs to mitigate the shock to global trade," he added.

Beijing has in the past few months reiterated its confidence that China could achieve the "around 5%" growth target for the year, and rolled out measures to bolster consumption and support the country's exporters.

A slew of monetary stimulus measures, including liquidity injections and cuts to policy rates, was announced on Wednesday in a bid to ease tariff hits on the economy.For now, the trade sector's momentum is still riding on the global scramble to make the most of Trump's brief tariff relief.

China's steel exports topped 10 million metric tons for a second straight month in April, as top customers like South Korea and Vietnam bought in bulk to outrun the tariffs, which analysts expect to disrupt China's lucrative transhipment trade.

With global copper producers rushing stocks to the U.S. after Trump proposed slapping levies on the metal, China's imports of unwrought copper and copper products remained unchanged last month.

Soybean imports plunged to a 10-year low in April, but this was due to prolonged customs clearance delays and late Brazilian shipments caused by harvest slowdowns and logistics issues.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post