Weekly Economics Report - May 26, 2025

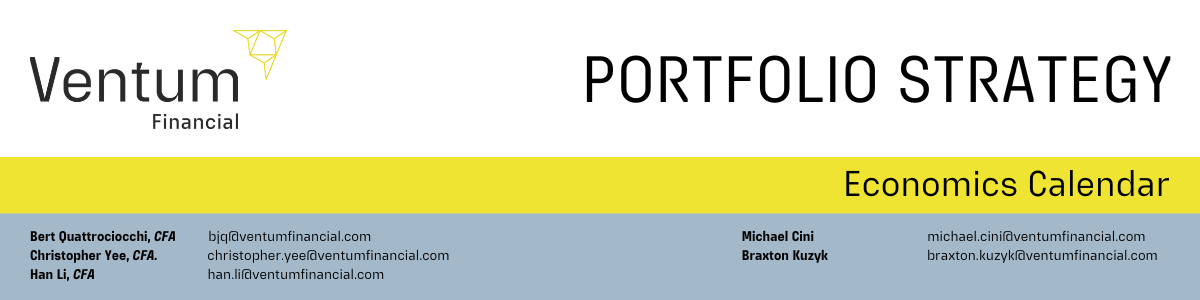

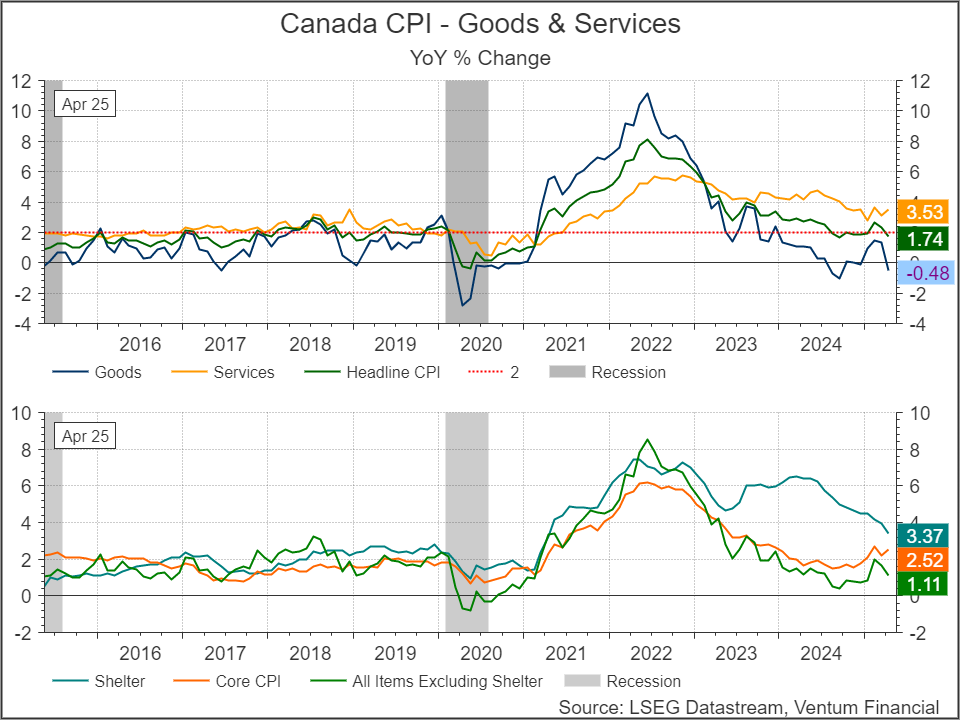

Canada’s annual inflation rate in April drops to 1.7%, but core measures rise

OTTAWA, May 20 (Reuters) - Canada's annual inflation rate eased to 1.7% in April as energy prices dropped sharply after the removal of a federal consumer carbon tax, but core inflation edged up, Statistics Canada said on Tuesday.

Two of the three core measures of inflation, which are closely watched by the Bank of the Canada, hit 13-month highs on underlying price pressures. Analysts had forecast the annual rate would ease to 1.6%, in April from 2.3% in March.

The Bank of Canada last month predicted it would fall to about 1.5%, mainly due to the removal of the carbon tax and lower crude prices. Overall energy prices plunged 12.7% last month as gasoline prices fell by 18.1% from a year earlier while year-over-year prices for natural gas dropped 14.1%.

Consumers, though, paid 3.8% more for groceries than they had done a year previously, up from 3.2% in March. Year over year, prices for travel tours rose 6.7% in April.

On a month-by-month basis, inflation dipped by 0.1% compared to analysts' forecasts of a 0.2% drop. The Canadian dollar strengthened 0.1% to C$1.3940 to the U.S. dollar, or 71.74 U.S. cents, after the data. It is the penultimate major data release before the Bank of Canada's next scheduled interest rate decision on June 4. Statscan is due to release first quarter GDP figures on May 30. The odds for a rate cut dipped to 48% from 65% before the release, currency swap market bets showed.

After seven consecutive cuts since last June the Bank held rates on April 16 while saying it would be ready to move decisively if needed to keep inflation under control. The bank pays particular attention to the core measures of inflation, which strip out the prices of more volatile items and do not take into account the removal of the carbon tax.

CPI median, which shows the median inflation rate across CPI components, rose from 2.8% in March to 3.2% in April, the highest since March 2024. CPI trim, which excludes upside and downside outliers, edged up from 2.9% to 3.1%, also a 13-month high.

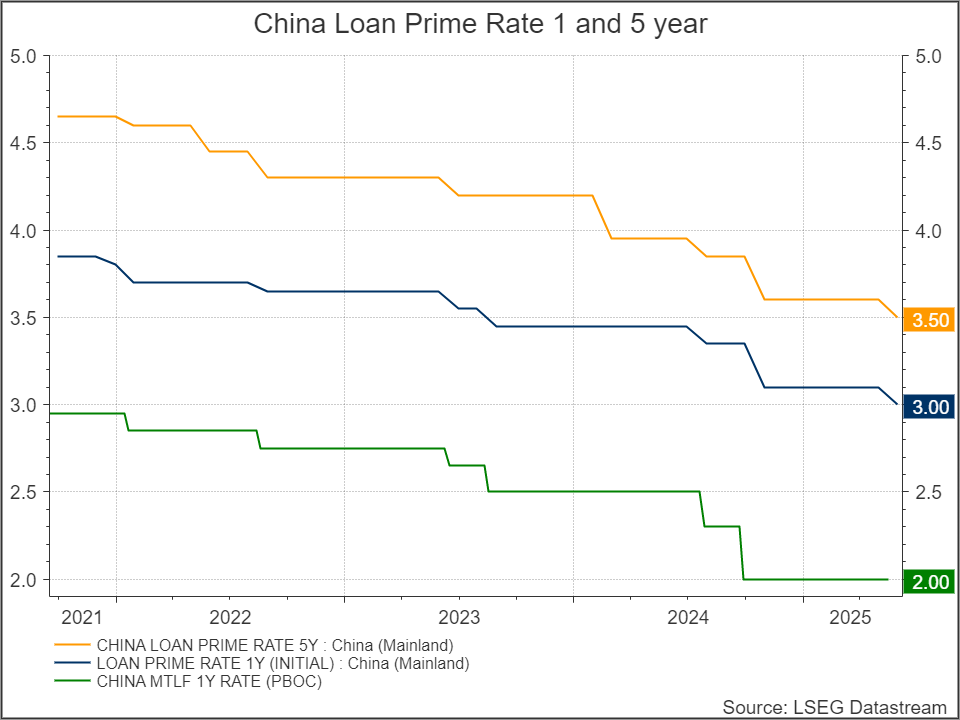

China lowers benchmark lending rates for first time since October

SHANGHAI, May 20 (Reuters) - China cut benchmark lending rates for the first time since October on Tuesday, after Beijing announced sweeping monetary easing measures earlier this month to support the broad economy.

The one-year loan prime rate (LPR) CNYLPR1Y=CFXS was lowered by 10 basis points to 3.0% from 3.1% previously, while the five-year LPR CNYLPR5Y=CFXS was reduced by the same margin to 3.5% from 3.6%.

Most new and outstanding loans in China are based on the one-year LPR, while the five-year rate influences the pricing of mortgages. Chinese authorities have announced a raft of stimulus measures, including interest rate cuts and a major liquidity injection, as Beijing steps up efforts to soften the economic damage caused by the trade war with the United States.

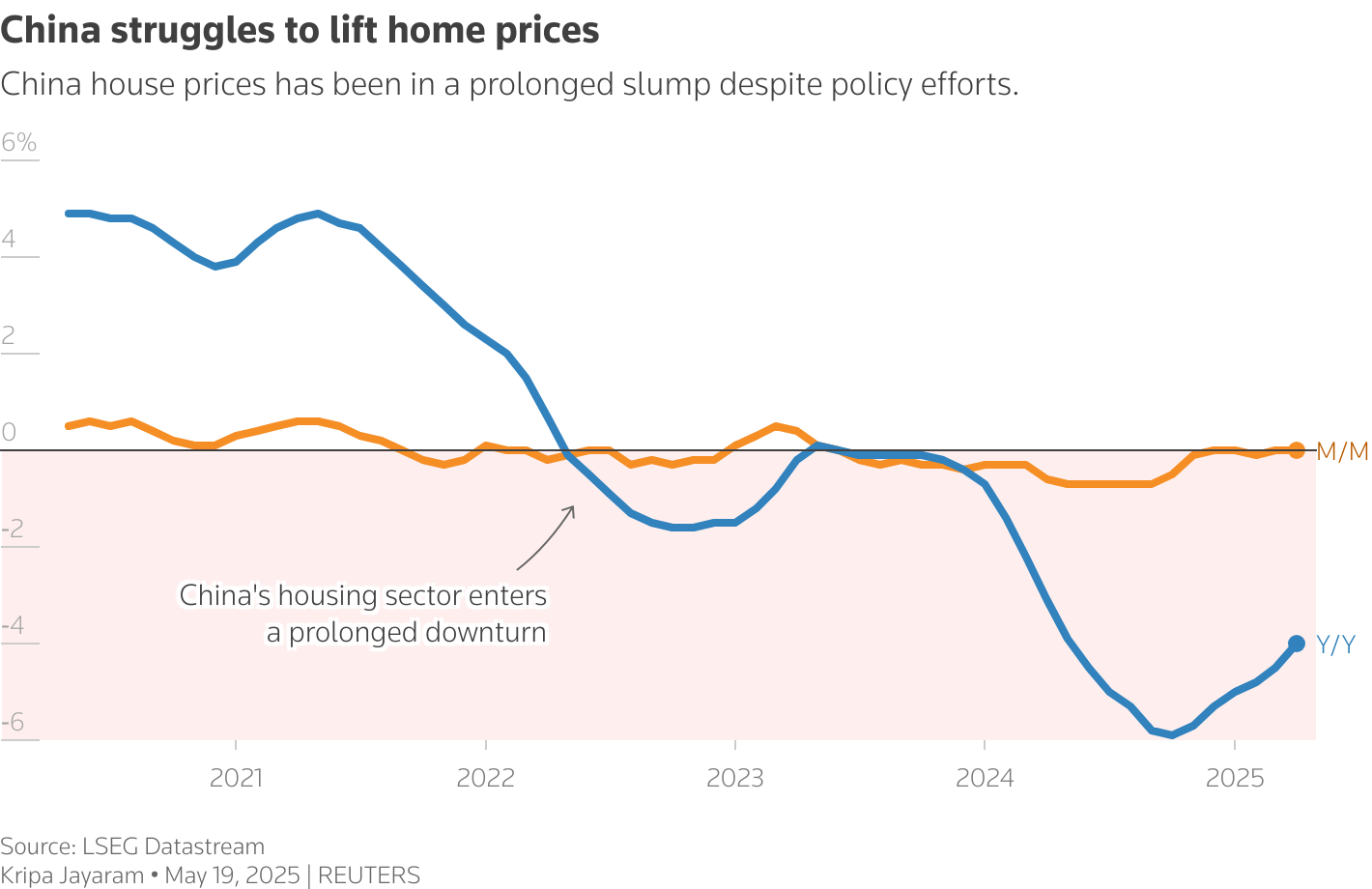

China struggles to lift home prices as April shows no growth

BEIJING, May 19 (Reuters) - China's new home prices were unchanged in April from a month earlier, official data showed on Monday, extending the no-growth trend to nearly two years despite policymakers' efforts to stabilise the sector.

New home prices stayed the same for a second straight month and have shown no growth since May 2023 as China attempts to lift the real estate sector, once a key driver of the economy, from a prolonged slump. "The property sector remains on a downward path. While many believe we're approaching the bottom, the exact distance remains uncertain," said Zhaopeng Xing, senior China strategist at ANZ.

From a year earlier, prices in April were down 4.0%, a slight improvement from a 4.5% decline last month, according to Reuters calculations based on data from China's National Bureau of Statistics.

Beijing has announced a raft of stimulus measures in recent weeks to bolster the economy amid trade uncertainties with the U.S., including trimming mortgage costs for some buyers to turn around a property crisis that began in 2021. Indebted developers have since struggled to repay their borrowings and deliver pre-sold homes, dampening confidence in the sector.

The April slowdown reflects diminishing policy stimulus effects, the impact of ongoing U.S.-China trade tensions, and seasonal demand contraction following March's traditional peak, said Zhang Dawei, chief analyst at property agency Centaline. "Policy interventions haven't fundamentally altered homebuyers' long-term market perspective," said Zhang. "Persistent economic uncertainty and income instability continue making potential buyers increasingly cautious."

Resale home prices declined across tier-one, tier-two, and tier-three cities on both a monthly and annual basis. Separate official data showed property investment dropped 10.3% year-on-year and sales by floor area shrank 2.8% in January-April.

The head of China's financial regulator promised to roll out more measures to help sustain the "stabilising trend of the property sector" at a high-profile press conference earlier this month. Meanwhile, the central bank cut the interest rate for housing provident fund loans by 25 basis points, effective May 8, reducing borrowing costs for some buyers. "The policy response clearly demonstrates the government's resolve to support real estate. Market participants now await stronger measures to restore confidence and avert further decline," said Centaline's Zhang.

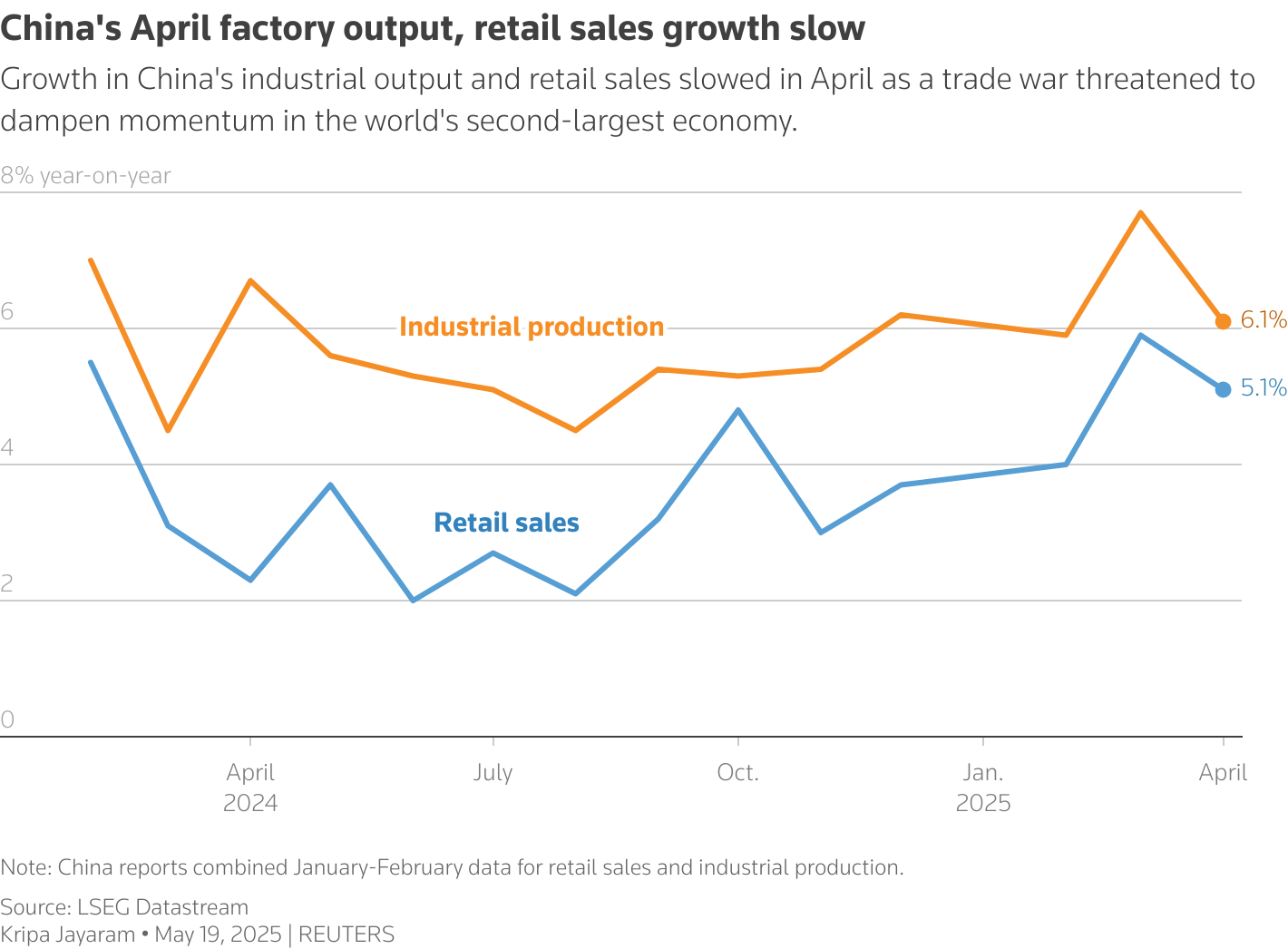

China’s factory output resists tariff impact, retail sales disappoint

BEIJING, May 19 (Reuters) - China's factory output slowed in April but showed surprising resilience, a sign that government support measures may have cushioned the impact of a trade war with the U.S. that threatens to derail momentum in the world's second-largest economy. Industrial output grew 6.1% from a year earlier, National Bureau of Statistics (NBS) data showed on Monday, slowing from 7.7% in March but beat a forecast 5.5% rise in a Reuters poll.

"April's resilience is in part a result of 'frontloaded' fiscal support," said Tianchen Xu, senior economist at the Economist Intelligence Unit, referring to stronger government spending. The data followed firmer-than-expected exports earlier this month that economists said were supported by exporters rerouting shipments and countries buying more materials from China amid a re-ordering of global trade due to U.S. President Donald Trump's tariffs.

However, Monday's data underscored the shock from U.S. reciprocal tariffs, Xu said, adding "despite the rapid growth in industrial value-added, the export delivery value was nearly stagnant."

Beijing and Washington reached a surprise agreement last week to roll back most tariffs imposed on each other's goods since early April. The 90-day pause has put the brakes on a trade war that has disrupted global supply chains and stoked recession fears. "China's foreign trade has overcome difficulties and maintained steady growth, demonstrating strong resilience and international competitiveness," Fu Linghui, statistics bureau spokesperson, told a press conference on Monday. He added that the trade de-escalation would benefit bilateral trade growth and global economic recovery.

But economists have warned that the short-term truce and U.S. President Donald Trump's unpredictable approach will continue to cast a shadow over China's export-driven economy, which still faces 30% tariffs on top of existing duties. By midday, China's blue-chip CSI300 Index .CSI300 dropped 0.4% and the Shanghai Composite Index .SSEC lost 0.1%. The yuan currency also slipped against the dollar.

PRESSURES REMAIN

The property sector has yet to show signs of recovery, with home prices stagnating and investment in the sector shrinking. Retail sales, a measure of consumption, rose 5.1% in April, down from a 5.9% increase in March, and missed forecasts for a 5.5% expansion. Economists attributed the slowdown to the impact of U.S. tariffs on consumer expectations and tepid demand at home.

Commodity sectors also showed signs of weakness with the country's daily crude oil processing rate down 4.9% in April from March, while crude steel output slid 7% month-on-month. Meanwhile, the government's push to boost household spending via a trade-in scheme for consumer goods led to a 38.8% gain in home appliance sales.

The NBS data also showed the unemployment rate fell to 5.1% from 5.2% in March. But anecdotal evidence showed that some factories heavily reliant on the U.S. market have sent their workers home. With persistent deflationary pressures and worse-than-expected bank lending data, economists highlighted the need for more policy support to foster a sustainable recovery.

"We caution that the near-term growth strength is at the cost of payback effects later and believe more policy easing is necessary to stabilise growth, employment and market sentiment," Goldman Sachs economists said in a note.

China's economy expanded 5.4% in the first quarter, exceeding expectations. Authorities remain confident of achieving Beijing's growth target of around 5% this year, despite warnings from economists that U.S. tariffs could derail this momentum. Alarmed by how tariffs have hurt economic activity, authorities earlier this month announced a package of stimulus measures, including interest rate cuts and a major liquidity injection.

The monetary easing measures were announced before the China-U.S. trade detente was reached after high-stakes talk in Geneva, marking a significant de-escalation from months of mounting tensions. The U.S.-China "deal" agreed at the start of last week will provide some relief, said Julian Evans-Pritchard, head of China Economics at Capital Economics, "but even if the tariff rollback proves durable, wider headwinds mean that we still expect China's economy to slow further over the coming quarters.""We suspect that the trade war has made households more concerned about their job prospects and therefore more careful about their spending."

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post